Breaking Down Startup Fundraising: From Pre-Seed to IPO

A Founder’s Guide to Successfully Navigating Each Stage of Investment and Securing the Right Funding

Check out this handy Funding Stage Cheat Sheet & investor list, specifically curated for early-stage founders at the end of the newsletter 👇

Now, let’s talk about the roadmap to securing funding for your startup. Fundraising is an essential part of building your business, but the process can feel daunting if you don’t know what to expect.

This newsletter breaks it all down, stage by stage—from pre-seed, where your ideas are just beginning to take form, to the IPO, where your startup becomes a full-fledged public company.

Along the way, you’ll learn about the purpose of each stage, the types of investors to connect with, and examples of startups that have successfully navigated this journey. With this guide, you’ll be better equipped to strategize, fundraise, and grow with confidence.

Xartup, in partnership with VCCircle and IIM Calcutta, is thrilled to announce the 2nd edition of The Pitch, India’s premier fundraising-focused pitching platform. Following a successful inaugural edition in Hyderabad, where over 40 pitches were delivered to 17 investors, The Pitch now heads to Kolkata.

Join us at IIM Calcutta for a unique opportunity to present your startup one-on-one to investors and turn your momentum into capital.

Different stages of funding

1. Pre-Seed Funding

Stage of Startup:

The earliest stage of a startup’s lifecycle, often referred to as the "bootstrapping phase." At this stage, the startup typically has a rough concept or a prototype, but no established product or market traction. The goal is to validate the problem-solution fit and develop a basic version of the product.Use of Funds:

Funds are used for initial research, developing a prototype, and covering operational costs like registering the business or hiring a small team.Potential Investors:

Friends and family

Angel investors

Early-stage micro funds like Seedcamp, K9 Ventures, and First Round Capital.

Funding Amount: $10,000–$250,000 (₹10 lakh – ₹2 crore)

Example:

Uber’s first funding came from co-founder Garrett Camp’s personal investment of $250,000, which helped build the app's prototype and launch in a single city.

2. Seed Funding

Stage of Startup:

The startup has a minimum viable product (MVP) and is conducting market testing. The company is building its first team and acquiring its first set of customers. The focus is on refining the product and establishing a product-market fit.Use of Funds:

Product development and improvement

Marketing to acquire early customers

Hiring core team members

Potential Investors:

Angel investors

Seed-focused venture capital funds

Crowdfunding platforms

Funding Amount: $250,000–$2 million (₹1 crore – ₹10 crore)

Example:

Airbnb raised a $600,000 seed round from Y Combinator and Sequoia Capital to enhance their platform and market their unique value proposition of “living like a local.”

3. Series A Funding

Stage of Startup:

The company has shown traction in terms of user growth, revenue, or product adoption. The business model is clear, and the focus shifts to scaling operations and entering new markets.Use of Funds:

Scaling the business (hiring, infrastructure, marketing)

Expanding product lines or geographical presence

Enhancing user acquisition strategies

Potential Investors:

Early-stage venture capital firms

Strategic investors with domain expertise

Funding Amount: $2 million–$15 million (₹10 crore – ₹100 crore)

Example:

Slack raised $42.75 million in Series A funding, which helped them improve their platform and expand their team, laying the foundation for exponential growth.

4. Series B Funding

Stage of Startup:

By this stage, the company is a growing business with strong market presence and proven unit economics. The startup aims to capture a larger market share, optimize operations, and create competitive barriers.Use of Funds:

Expanding operations to new regions

Building partnerships or acquiring complementary businesses

Strengthening technology and operational efficiency

Potential Investors:

Larger venture capital firms

Institutional investors like hedge funds and private equity firms

Funding Amount: $15 million–$50 million (₹50 crore – ₹200 crore)

Example:

Swiggy raised $15 million in its Series B round from SAIF Partners and Accel, which allowed it to rapidly expand its delivery network across multiple Indian cities.

5. Series C Funding

Stage of Startup:

The startup is a mature company looking to dominate the market. Series C is often used to prepare for large-scale growth initiatives, such as entering global markets or introducing new revenue streams.Use of Funds:

Launching international operations

Acquiring smaller competitors

Introducing new products or services

Potential Investors:

Private equity firms

Investment banks

Strategic corporate investors

Funding Amount: $50 million–$100 million (₹200 crore – ₹500 crore)

Example:

BYJU’S raised $75 million in Series C to expand its educational content portfolio and establish a foothold in international markets.

6. Series D Funding (and Beyond)

Stage of Startup:

Typically raised by companies seeking additional funding to sustain operations, boost their valuation before an IPO, or address financial gaps. This stage may indicate growth challenges or the need to fund significant strategic moves.Use of Funds:

Addressing operational challenges

Preparing for acquisition or IPO

Further international or product expansion

Potential Investors:

Late-stage venture capital firms

Private equity investors

Funding Amount: $100 million–$200 million (₹500 crore – ₹1,000 crore)

Example:

Flipkart raised $1.4 billion in its Series D round, which helped it secure its position in India’s competitive e-commerce landscape.

7. Mezzanine Funding and Bridge Loans

Stage of Startup:

This stage typically occurs when a company is close to an IPO or an acquisition and needs short-term funding to cover immediate expenses. This funding is often a mix of equity and debt financing.Use of Funds:

Addressing liquidity needs before IPO or acquisition

Scaling operations to make the company IPO-ready

Paying off previous debts

Potential Investors:

Banks

Venture debt firms

Private equity funds

Example:

Zomato used bridge financing to strengthen its liquidity before launching its IPO.

8. Initial Public Offering (IPO)

Stage of Startup:

The company goes public and offers its shares to institutional and retail investors. The IPO signals that the company has reached maturity and is seeking broader funding to fuel future growth.Use of Funds:

Expanding aggressively

Diversifying into new markets or product categories

Paying off earlier investors or debts

Potential Investors:

Retail investors

Institutional investors such as mutual funds and pension funds

Example:

Nykaa raised ₹5352 crore through its IPO in 2021, cementing its position as a leader in the beauty and wellness sector while achieving significant market visibility.

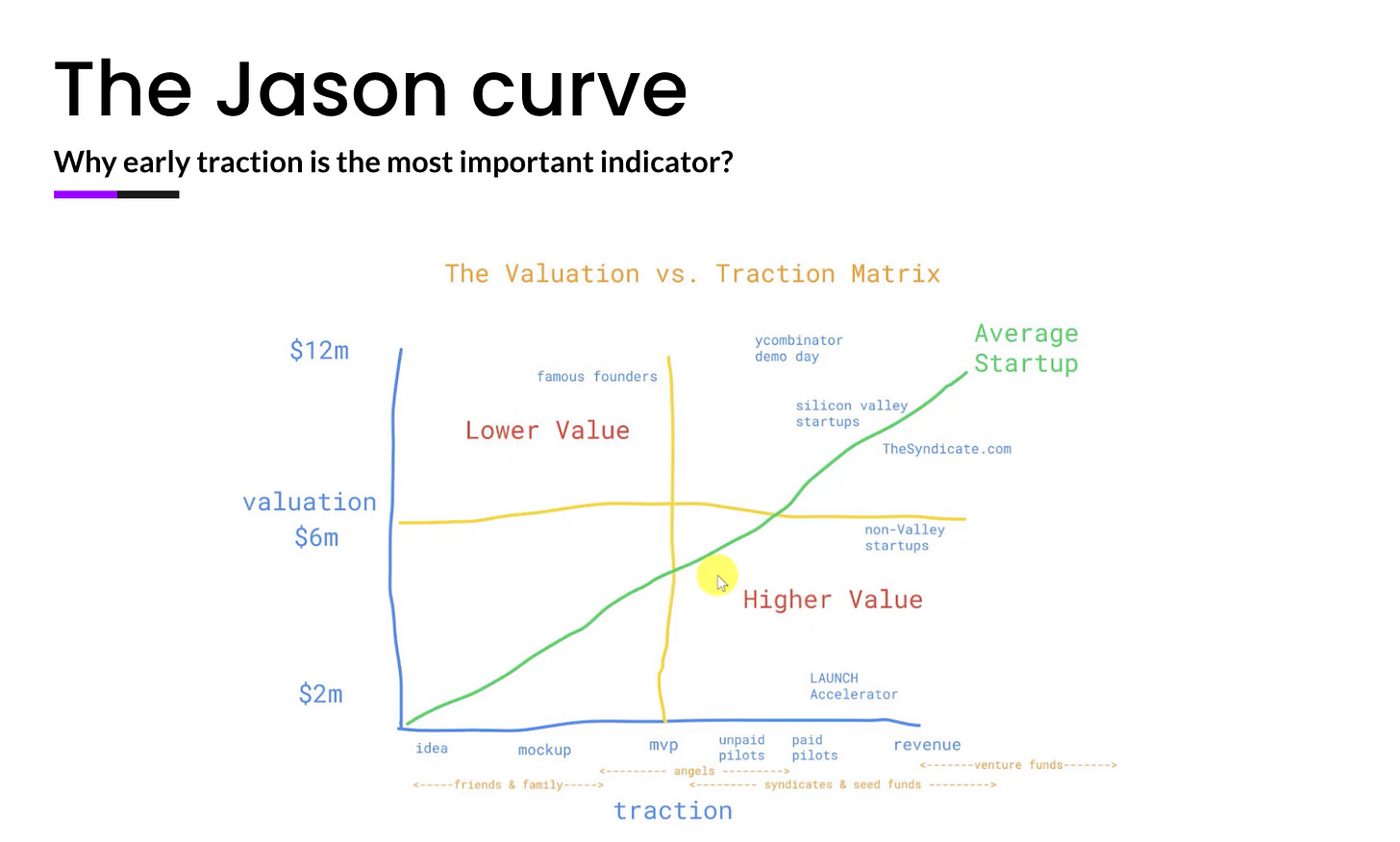

Understanding the Jason Curve and Its Role in Fundraising

The Jason Curve provides valuable insights into the relationship between traction and startup valuation at various stages of fundraising. It emphasizes that early traction—even before achieving substantial revenue or market dominance—is one of the most significant factors influencing a startup’s valuation.

As a founder, understanding the Jason Curve can help you make strategic decisions about when and how to approach investors:

Early Traction = Higher Valuation: The curve shows that startups demonstrating even modest early traction can command higher valuations. Whether it's product validation, user engagement, or pilot customers, these early signs of growth signal to investors that your business is on the right path.

Focus on Progress Over Perfection: In the early stages of fundraising, the focus should be on demonstrating momentum. Founders who can show that they are making progress—rather than waiting for perfection—are more likely to attract funding.

Fundraising Strategy: Understanding where your startup fits within the Jason Curve allows you to better time your fundraising efforts. For example, if your startup has reached an MVP stage with initial users or pilots, you might be ready for a seed or Series A round, with a higher valuation backed by real traction.

In essence, the Jason Curve teaches that traction is everything. The more proof points you can show to investors early on, the more likely you are to secure funding at favorable terms as you scale.

Final advice for founders for fundraising at each stage:

Fundraising is as much an art as it is a science. Knowing where your startup stands and aligning your funding goals with your growth milestones is crucial for long-term success. Don’t rush into rounds without understanding the implications of equity dilution, investor expectations, and your long-term vision.

👉 Download the complete Funding Stage Cheat Sheet and investor list tailored for early-stage founders.

If you're building a business, apply to the Xartup Fellowship Program and join a thriving community of 2,500+ founders tackling one of the toughest times in the Indian startup ecosystem.

The Xartup Fellowship has been an incredible journey for its Fellows:

2,500+ Alumni

300+ Startups

$5M+ in Funding Raised by Alumni