Crowdfunding in India: Great Chance or Big Mistake?

Explore the Diverse Opportunities Crowdfunding Offers in India

In recent years, crowdfunding has transformed the fundraising landscape in India, offering crucial support for a range of causes, including medical treatments, personal emergencies, and nonprofit initiatives. As this innovative model becomes more popular, many people are raising questions about its legality, safety, and overall effectiveness.

In this blog, we will explore what crowdfunding actually is, its types, and examine the pros and cons. Finally, we’ll highlight the top crowdfunding platforms in India, complete with application links.

What is Crowdfunding?

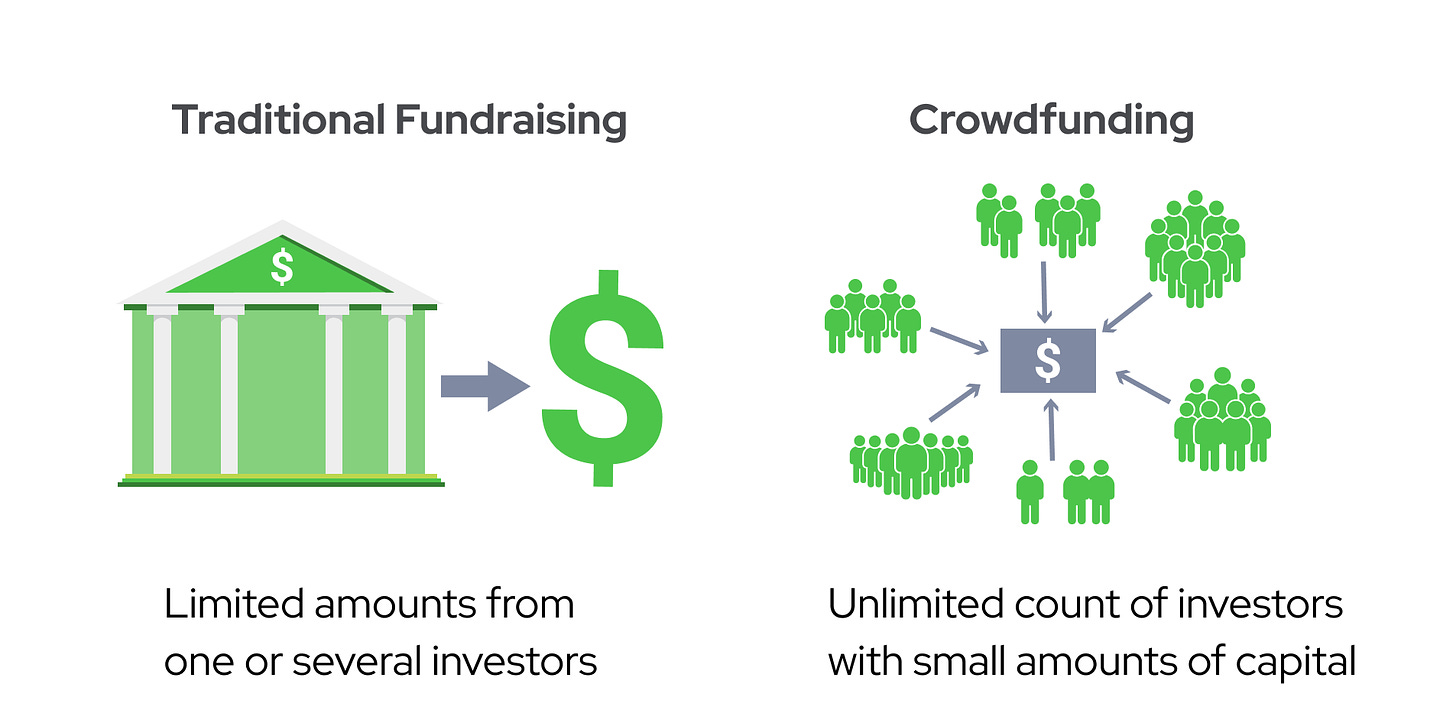

Crowdfunding is the process of raising capital through small contributions from a large number of people, usually via online platforms. Unlike traditional funding methods, which often involve large investments from a single source or a few investors, crowdfunding democratizes the funding landscape, allowing anyone to contribute to projects they believe in.

In recent years, crowdfunding has seen explosive growth, particularly in India. As of 2023, the Indian crowdfunding market is projected to exceed ₹100 billion (approximately $1.3 billion), with a compound annual growth rate (CAGR) of over 30%. This surge is driven by the increasing number of startups and the rise of digital platforms that facilitate these transactions.

Types of Crowdfunding and Their Legal Status in India

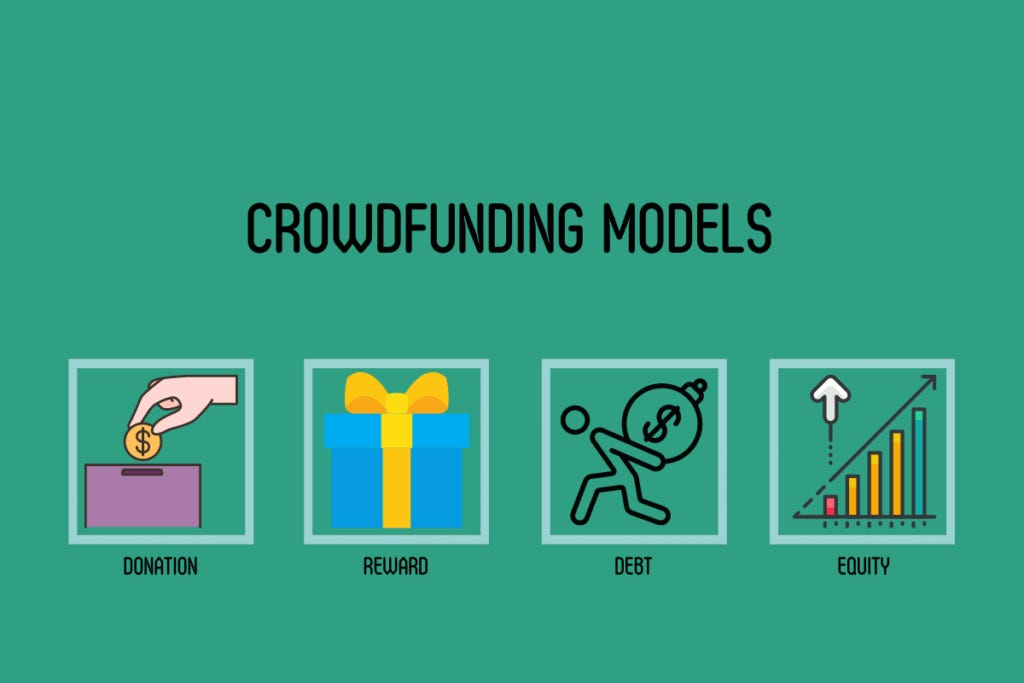

The Indian government has categorized crowdfunding into five distinct types, each with its own legal status and implications. Let’s explore each category, including an overview, ideal business types, and platforms that facilitate these funding methods.

1. Donation-based Crowdfunding

Overview: Donation crowdfunding involves individuals contributing money without expecting financial returns, primarily to support social causes, charitable initiatives, or personal emergencies. This type of crowdfunding is fully legal in India, providing a robust avenue for individuals to support causes ranging from education to disaster relief.

Ideal For:

Nonprofit organizations

Social enterprises

Individuals facing medical emergencies or community challenges

2. Pre-Order Crowdfunding

Overview: In pre-order crowdfunding, contributors pledge funds to receive a product or service at a future date, essentially pre-purchasing it before its official launch. This method is legally permissible in India, allowing businesses to gauge interest and secure funds for product development.

Ideal For:

Startups and entrepreneurs launching new products

Established businesses testing market interest for new offerings

Platforms: Kickstarter, Indiegogo, Wishberry

3. Reward Crowdfunding

Overview: Reward crowdfunding enables contributors to fund projects in exchange for tangible rewards, which can include products, services, or exclusive experiences. This type is legal in India and fosters innovation by allowing creators to offer rewards to their supporters.

Ideal For:

Creative industries (films, music, art)

Innovative tech products and startups

Platforms: Ketto, Wishberry, Kickstarter

4. Debt Crowdfunding

Overview: In this model, numerous retail investors (the crowd) provide loans to businesses or individuals through an online platform. By cutting out many intermediaries that would usually be involved in traditional banking, debt crowdfunding lowers costs for borrowers and can deliver more attractive returns for lenders. It is recognized as a legal financing option in India, providing a practical solution for those in need of financial support without relying on traditional banks.

Ideal For:

Small businesses and startups needing quick funding

Individuals seeking personal loans without traditional banking hurdles

Platforms: Faircent, Lendingkart, Cashkumar

5. Equity-Based Crowdfunding

Overview: Equity crowdfunding allows businesses to raise capital by offering shares to online investors, enabling them to become part-owners. However, this model is currently illegal in India due to regulatory constraints. While it is widely accepted in many other countries, Indian regulations have yet to adapt to support it.

Ideal For:

Startups seeking substantial capital for growth

Businesses willing to share equity in exchange for funding

Platforms: While not currently legal in India, platforms like LetsVenture and Crowdcube operate in jurisdictions where equity crowdfunding is permitted.

Top 10 Crowdfunding Platforms in India

With the rise of crowdfunding, several platforms have emerged to help individuals and startups raise funds. Here’s a quick look at the top crowdfunding platforms in India, including their fees, ideal business types, and funding amounts raised last year and application links where you can apply:

1. Ketto

Overview: Ketto charges around 5% of the funds raised, plus payment processing fees. It’s ideal for personal causes, healthcare, education, and social projects. Last year, it raised approximately ₹1,000 crores.

Application Link: Ketto

2. Milaap

Overview: Milaap has a 5% platform fee and a 2% payment processing fee. It’s suited for medical emergencies, education, and social causes. The platform raised about ₹800 crores last year.

Application Link: Milaap

3. Wishberry

Overview: Wishberry charges a 5% fee on the total funds raised if the goal is achieved. It’s ideal for creative projects, arts, films, and innovations. Last year, it raised around ₹50 crores.

Application Link: Wishberry

4. Faircent

Overview: Faircent’s charges vary by loan amount, generally ranging from 1% to 5%. It’s ideal for peer-to-peer lending for personal and business loans, raising approximately ₹1,500 crores last year.

Application Link: Faircent

5. Lendingkart

Overview: Lendingkart’s interest rates typically range from 18% to 24% per annum on loans. It’s suited for small businesses and startups needing quick loans, raising around ₹1,000 crores last year.

Application Link: Lendingkart

6. Impact Guru

Overview: Impact Guru charges a 5% platform fee plus payment gateway charges. It’s ideal for social projects, startups, and personal causes, raising about ₹400 crores last year.

Application Link: Impact Guru

7. PledgeMusic

Overview: PledgeMusic charges 15% of total funds raised. It’s ideal for musicians and artists seeking funding for albums or tours, with previous years raising around ₹50 crores.

Application Link: PledgeMusic

8. SeedInvest

Overview: SeedInvest charges a 7.5% fee on raised funds. It’s ideal for startups looking for equity investment, raising approximately ₹500 crores in India-specific initiatives last year.

Application Link: SeedInvest

9. Crowdera

Overview: Crowdera has no platform fees, with donations processed through payment gateways. It’s ideal for nonprofits, social initiatives, and startups, raising around ₹200 crores last year.

Application Link: Crowdera

10. Givengain

Overview: Givengain charges 5% of funds raised. It’s ideal for charitable causes and nonprofit organizations, raising approximately ₹300 crores last year.

Application Link: Givengain

Pros and Cons of Crowdfunding in India

Pros:

Access to Funding: Crowdfunding provides an alternative source of capital for startups and individuals who may find it difficult to secure traditional loans.

Market Validation: It allows entrepreneurs to test their ideas and gauge market interest, reducing the risk of launching unproven products.

Community Support: Backers often feel a personal connection to projects, fostering a sense of community and shared purpose.

Reduced Financial Risk: Entrepreneurs can raise funds without taking on debt or giving away significant equity, minimizing financial pressure.

Cons:

Regulatory Challenges: The lack of comprehensive regulations in India can lead to potential scams and fraud, putting investors at risk.

Funding Uncertainty: There is no guarantee of reaching the funding goal, which can result in wasted effort and resources if the campaign fails.

Fees and Charges: Most platforms charge fees on the funds raised, which can reduce the total amount available to the project creator.

Public Exposure: Launching a campaign means exposing the project idea to the public, which could lead to idea theft or copying.

Conclusion

To wrap up, crowdfunding has become an essential tool in India’s fundraising landscape, enabling individuals and organizations to support a variety of causes. While it offers significant advantages like community engagement and access to capital, it’s crucial to navigate the potential risks and understand the legal framework. By choosing the right platform and approach, you can effectively harness the power of crowdfunding to make a meaningful impact.

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$9M+ in funding raised by Alumni