ESOP Buybacks & Founder Liquidity: The New Fundraising Milestone

Why startups are turning equity into cash and how buybacks are becoming the hottest new milestone in fundraising.

“It used to be a paper promise. Now, it’s real money.”

That’s how a Meesho employee described their ESOP buyback in March 2024. And they’re not alone.

This year, over 3,000 startup employees in India unlocked wealth worth ₹1,450+ crore (~$170 million)—without waiting for an IPO or acquisition.

This isn't a fluke. It’s a movement.

What Is an ESOP Buyback?

An ESOP buyback is when a company repurchases vested stock options from employees, turning their notional equity into actual cash.

In private companies, there’s no stock market to sell your shares. So, a buyback acts like an internal exit, approved by the board, funded either by cash reserves or through a secondary sale during funding.

Think of it as a controlled liquidity window:

The company sets the price

Employees choose how much equity to sell

Everyone walks away with cash and cleaner cap tables

Why Are Startups Offering Buybacks?

1. Liquidity Without IPO Pressure

Startups are staying private longer. IPOs feel miles away. Buybacks give employees a real financial reward today.

2. Talent Retention Strategy

A buyback says: “We don’t just promise equity—we pay for it.”

This boosts morale, trust, and long-term retention.

3. Cap Table Clean-Up

Buybacks from ex-employees or early-stage holders simplify ownership structures—a must before raising a big round or prepping for IPO.

4. ESOP Pool Recycling

Instead of expanding the ESOP pool (and diluting more), startups reissue freed-up options from buybacks to attract new talent.

What’s Driving the Surge in 2024?

The macro backdrop:

IPO markets are still shaky

VC funding is cautious

Founders want to reward employees, without over-diluting

And with equity management tools like EquityList and Qapita, structuring a buyback is easier than ever.

So what’s happening on the ground?

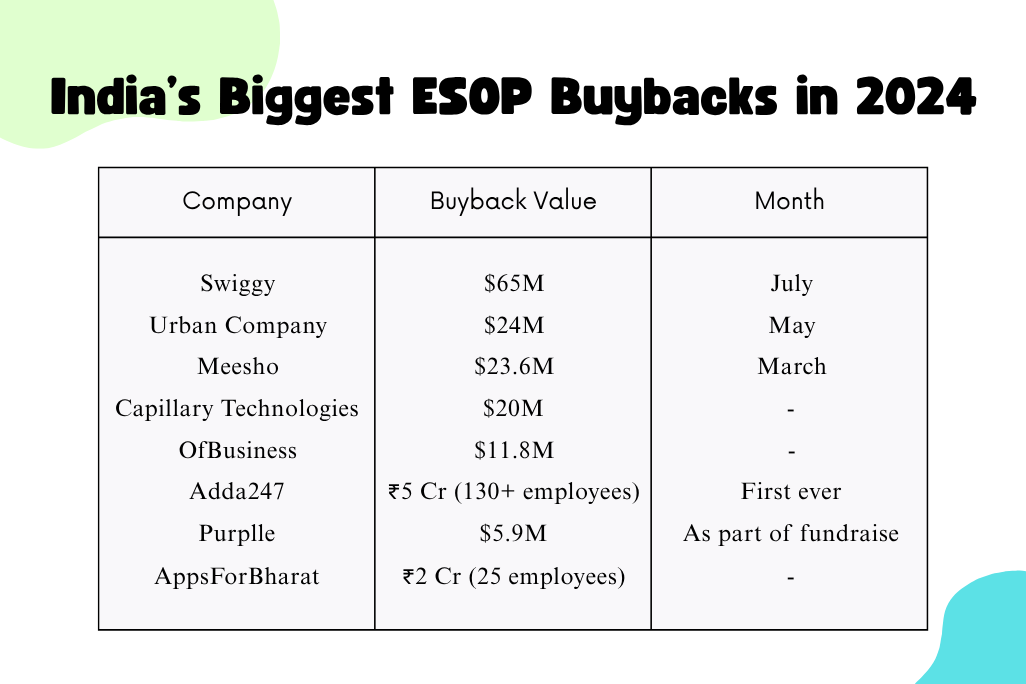

India’s Biggest ESOP Buybacks in 2024

ESOP Buyback vs Secondary Sale — What's the Difference?

In an ESOP buyback, the company itself buys back shares from employees—usually after a funding round or once it's cash-rich. It's mainly done to reward employees and manage the cap table. The company sets the price, often based on fair market value (FMV).

In contrast, a secondary sale happens when employees or existing investors sell their shares to new investors. It adds new names to the cap table and the price is negotiated between the buyer and seller. It's common during large fundraising rounds to offer early liquidity.

When Do Startups Typically Do ESOP Buybacks?

Startups often do buybacks:

Right after raising a big funding round (when they have cash to reward the team).

Once they hit profitability and can afford liquidity without external funds.

During pre-IPO cleanup to simplify ownership before listing.

Alongside a secondary round, giving liquidity to employees.

As a recurring program—some mature startups run annual buybacks to retain top talent.

Why ESOP Buybacks Matter to Employees

Buybacks turn equity into real wealth—employees can use the money to pay off loans, buy a home, or invest.

They also don’t have to wait a decade for an IPO to benefit from their hard work.

It gives people real motivation—“If I stay and perform, the company shares the upside.”

It reinforces ownership—employees feel like true stakeholders, not just salaried staff.

Xartup is excited to announce its collaboration with India’s premier fundraising platform for startups – The Pitch by VCCircle, now coming to Bangalore on June 28th!

This is your exclusive chance to pitch your startup 1:1 to India’s top investors, including those from Blume Ventures, Lightspeed, 100X.VC, Bessemer Venture Partners, and many more.

Apply now and move one step closer to scaling your startup!

What’s Coming in FY 2025?

Expect more early-stage buybacks: Companies like Adda247 have shown that you don’t need to be a unicorn to reward your team.

Institutionalized liquidity is on the rise: Top-tier startups may make buybacks a regular, even annual, practice.

Better structures are emerging: Startups are getting smarter about taxes, timing, and legal frameworks to make buybacks cleaner and more rewarding for everyone involved.

Bonus Resources for Founders:

Mercury’s Guide to Secondary Sales – A practical breakdown of how secondary sales work, when to do them, and how founders can plan for them.

Carta's ESOP Buyback Guide – A detailed guide on structuring ESOP buybacks, including tax, legal, and stakeholder communication insights.

Qapita: India-specific Equity Tools – An equity management platform designed for Indian startups to manage cap tables, ESOPs, and liquidity events with compliance.

EquityList by AngelList India – A free tool for managing ESOPs, fundraising rounds, and ownership structures, tailored for early to mid-stage Indian startups.

Wrapping It Up

As more startups delay IPOs and employees look for tangible returns, ESOP buybacks are quickly becoming a core part of a startup’s growth playbook.

They create liquidity without a public listing, align teams with long-term vision, and make equity feel real — not just theoretical.

Whether you’re exploring your first buyback, preparing for a raise, or just thinking long-term — understanding this tool puts you in a stronger position.

Hope this edition gave you a clearer lens on where startup equity is heading in 2025.

And if it sparked a new idea or helped you reframe something in your journey — that’s a win.

Catch you in the next one.

How Xartup Helps You Fundraise Smarter

Instead of blindly reaching out to investors, use a strategic approach:

✅ Leverage Xartup’s Investor Database to find the right VCs based on sector & stage.

✅ Join the Xartup Fellowship to access mentorship & growth resources.

✅ Get Technical Credits to test your product and many more.

🚀 Ready to optimize your fundraising? Join xartup.com