From Seed to Series A: Unlocking the Next Level of Startup Fundraising

Your roadmap to raising Series A funding and securing the fuel for exponential growth

Don’t forget to check out the list of Series A investors at the end of the newsletter! 👇

Do you know only 48% of startups that raise seed funding make it to a Series A round?

Think about that for a moment—less than half!

The competition is intense, and the bar is high.

The average Series A round in India today ranges between $8M to $10M, with investors typically taking 15%-25% equity.

What does this mean for you as a founder?

It means that standing out isn’t just an option—it’s a necessity. Series A is where your startup evolves from “promising” to “proven,” and investors will be looking for clear signs that you’re ready to scale.

If you’ve just wrapped up seed funding and are gearing up for the next big milestone, this guide will help you unlock the strategies and insights needed to secure that Series A win. Let’s dive in.

Here’s your step-by-step roadmap to raising Series A funding:

1. Set Milestones Early

Prepare for your Series A at least six months before your runway ends. Define clear milestones such as hitting revenue targets, acquiring users, or building a market-ready product. These milestones should showcase growth and validate your product-market fit to investors, setting a clear path to success.

2. Prioritise Fundraising

Fundraising is a full-time job. Dedicate at least 50% of your time to this process. Delegate operational tasks to your team, so you can focus on investor meetings, refining your pitch, and building relationships. A distracted founder can send the wrong message to potential investors.

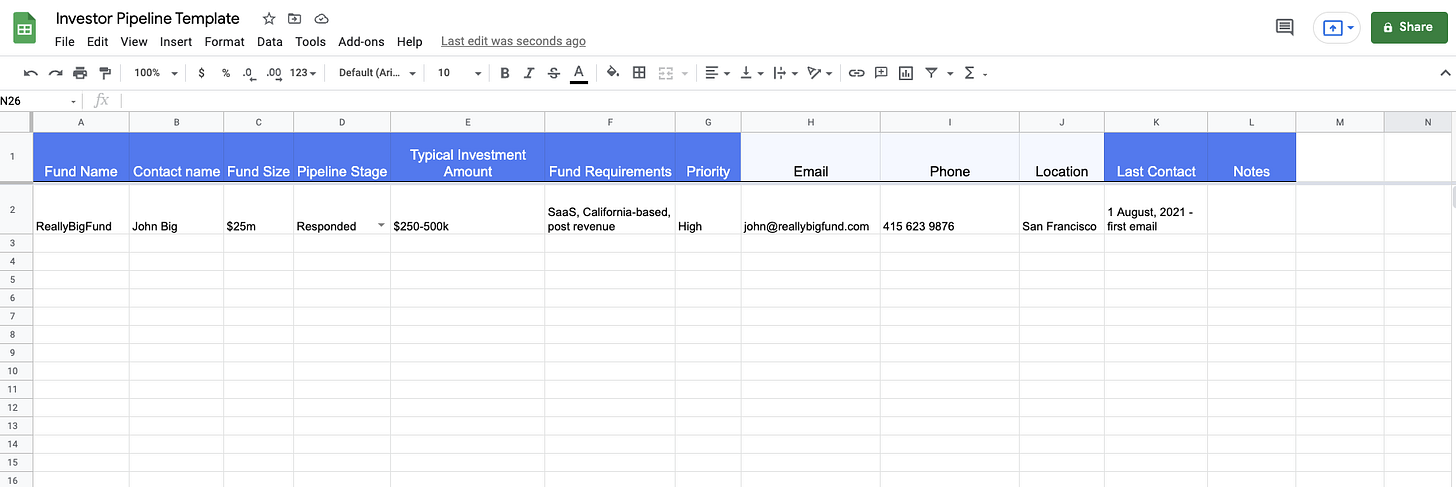

3. Build an Investor List

Identify VCs that align with your startup’s industry and growth stage. Curate a list of investors with relevant expertise. Aim for warm introductions through your network or advisors—cold outreach is less effective in today’s competitive fundraising environment. Below is how you can build your investor pipeline template:

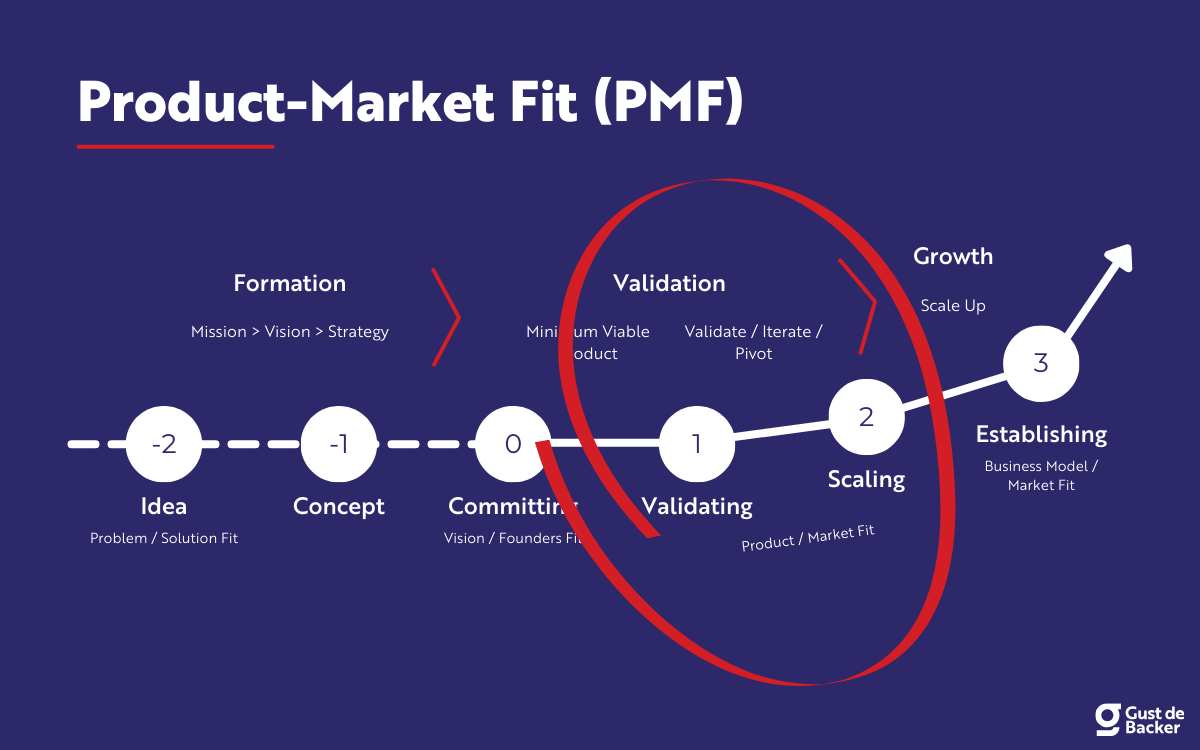

4. Prove Product-Market Fit

Investors want proof that your product resonates with users. Show that people love your product, need it, and are willing to pay for it. Tools like customer surveys, NPS scores, and testimonials are essential. Demonstrating product-market fit is critical for securing Series A funding.

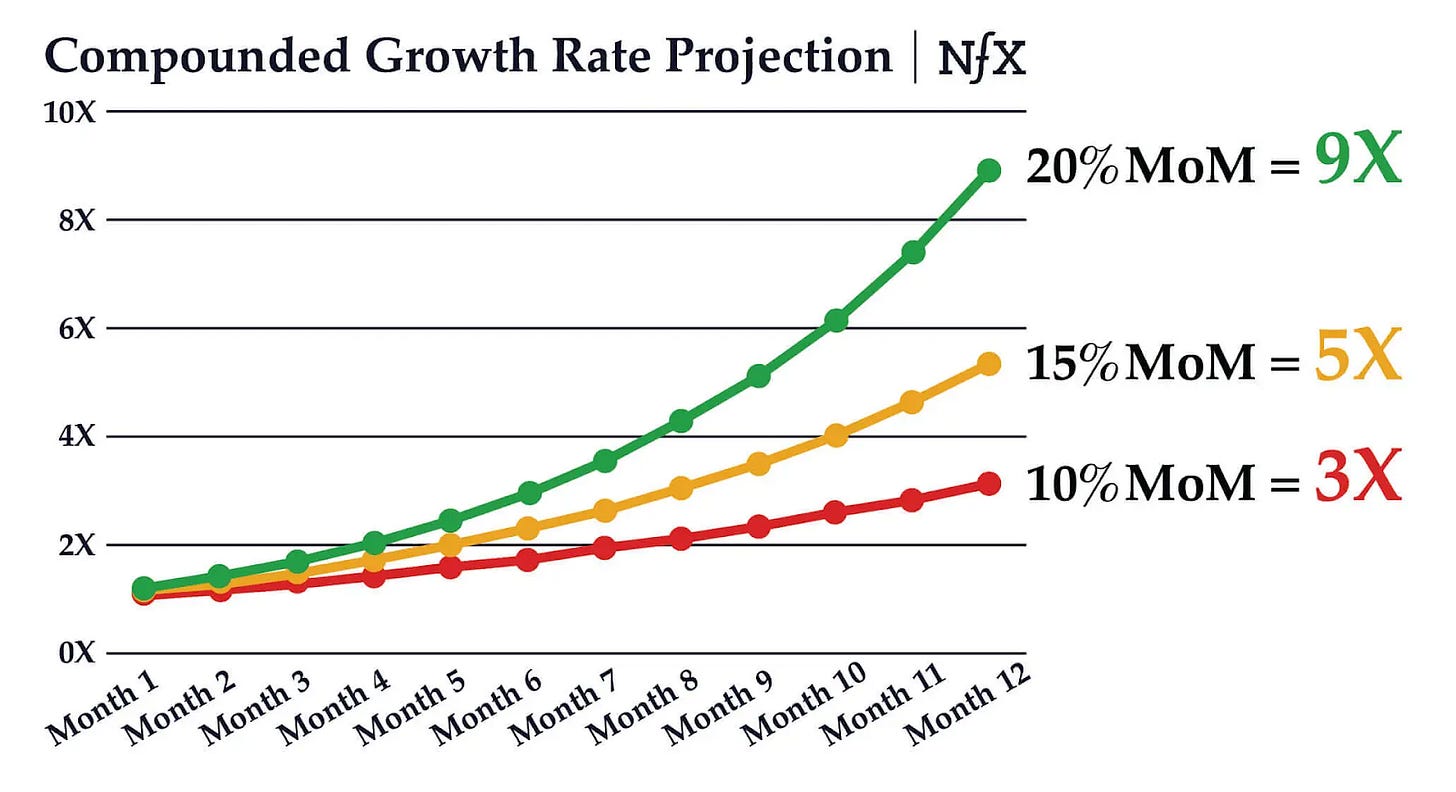

5. Track Growth Metrics

Investors need to see that your business is growing. Focus on key metrics like revenue, active users, and customer retention. Aim for steady 10-15% MoM growth and present detailed charts to emphasize your progress. Your numbers should tell a compelling story of growth and opportunity.

Here’s how a 10%, 15%, and 20% month-over-month growth rate compounds over the course of a year.

6. Show Traction That Speaks for Itself

Investors want to see real, measurable traction. Share your revenue growth (e.g., hitting $1M+ ARR or 3x YoY growth) and customer retention metrics (e.g., high user stickiness). An example of this is Razorpay, which impressed investors with 100K+ businesses using their platform before Series A.

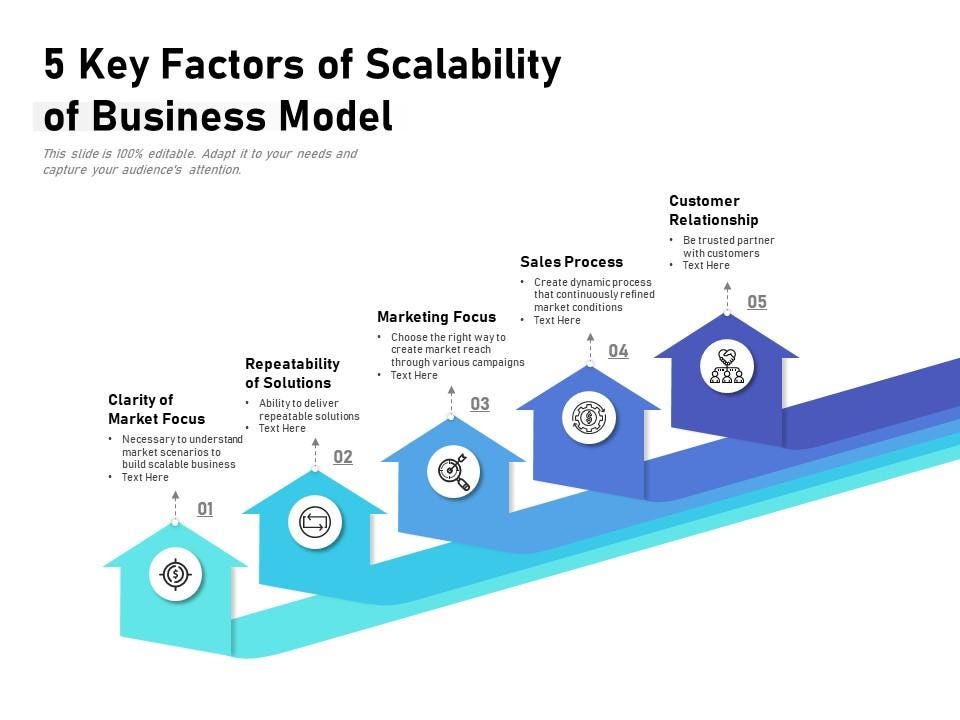

7. Build a Scalable Business Model

Demonstrate that your business can scale efficiently. Investors look at your CAC vs. CLV ratio (low customer acquisition cost with high lifetime value) and unit economics. Make sure you can prove your ability to grow without incurring excessive costs.

8. Craft a Compelling Narrative

Investors need to feel emotionally and rationally connected to your startup. Share the problem you're solving, your unique approach, and your vision for the future. Use strong data points to show your traction, and highlight how your solution will disrupt the market.

If you're building a business, apply to the Xartup Fellowship Program and join a thriving community of 2,500+ founders tackling one of the toughest times in the Indian startup ecosystem.

The Xartup Fellowship has been an incredible journey for its Fellows:

2,500+ Alumni

300+ Startups

$5M+ in Funding Raised by Alumni

9. Create Scarcity and Urgency

Create a sense of urgency among investors by setting a clear funding timeline and demonstrating interest from other VCs. By fostering FOMO (fear of missing out), you can compel investors to act quickly and push the terms in your favor.

10. Build Relationships Early

Don’t wait until you’re fundraising to meet potential investors. Start building relationships 6-12 months in advance. Regularly update investors on your progress, milestones, and vision. By the time you’re ready to raise, you’ll have existing champions who are eager to support your journey.

Final Advice for Founders

Securing Series A funding is about more than just having a great idea—it’s about showing investors that your startup is ready for the big leagues. Focus on building a compelling narrative backed by solid metrics and a growth-oriented vision.

Remember, Series A funding is not the destination but the means to scale your startup toward greater goals.

Check out the list of Series A Investors from various resources below:

- Gilion Series A VC firms & Investors

- SeedTable Active Series A Investors

- Signal Series A Investors List

If you're building a business, apply to the Xartup Fellowship Program and join a thriving community of 2,500+ founders tackling one of the toughest times in the Indian startup ecosystem.

The Xartup Fellowship has been an incredible journey for its Fellows:

2,500+ Alumni

300+ Startups

$5M+ in Funding Raised by Alumni