Guide to Equity Dilution during Fundraising process

Master Equity Structures, Allocation Strategies, and Valuation Techniques to Secure Early-Stage Funding

At the end, don’t miss the Startup Equity Dilution Calculator, designed specifically for early-stage founders 👇

Startup equity is one of the most critical levers in building a successful business. Whether you're raising funds, building a team, or rewarding early supporters, understanding how to allocate equity can define your journey as a founder.

This guide breaks down everything you need to know about issuing equity—from understanding what startup equity is to real-world examples of how startups distribute it during early-stage funding.

What Is Startup Equity?

Startup equity represents ownership in a company. It is typically divided into shares that indicate how much of the company someone owns. For startups, equity is often the currency for attracting talent, advisors, and investors.

Why is Startup Equity Important?

Incentive for Growth: Aligns the interests of founders, employees, and investors with the success of the company.

Capital Without Debt: Allows startups to raise money without taking on loans.

Long-term Commitment: Encourages key stakeholders to stay invested in the company’s journey.

Who Should Own a Piece of Your Startup?

Here’s a breakdown of typical equity recipients:

Founders:

Founders often hold the majority share at the beginning, reflecting their role in starting and shaping the company.

Over time, their stake may dilute as they issue equity to employees and investors.

Employees:

Employees are usually granted equity through Employee Stock Ownership Plans (ESOPs) to incentivize their contribution to the company’s growth.

Advisors:

Equity compensates advisors for providing expertise or mentorship. This is often a small percentage (0.25%-2%).

Investors:

Receive equity in exchange for funding. Early-stage investors like angel investors or venture capitalists typically get preferred stock with specific rights (e.g., liquidation preference).

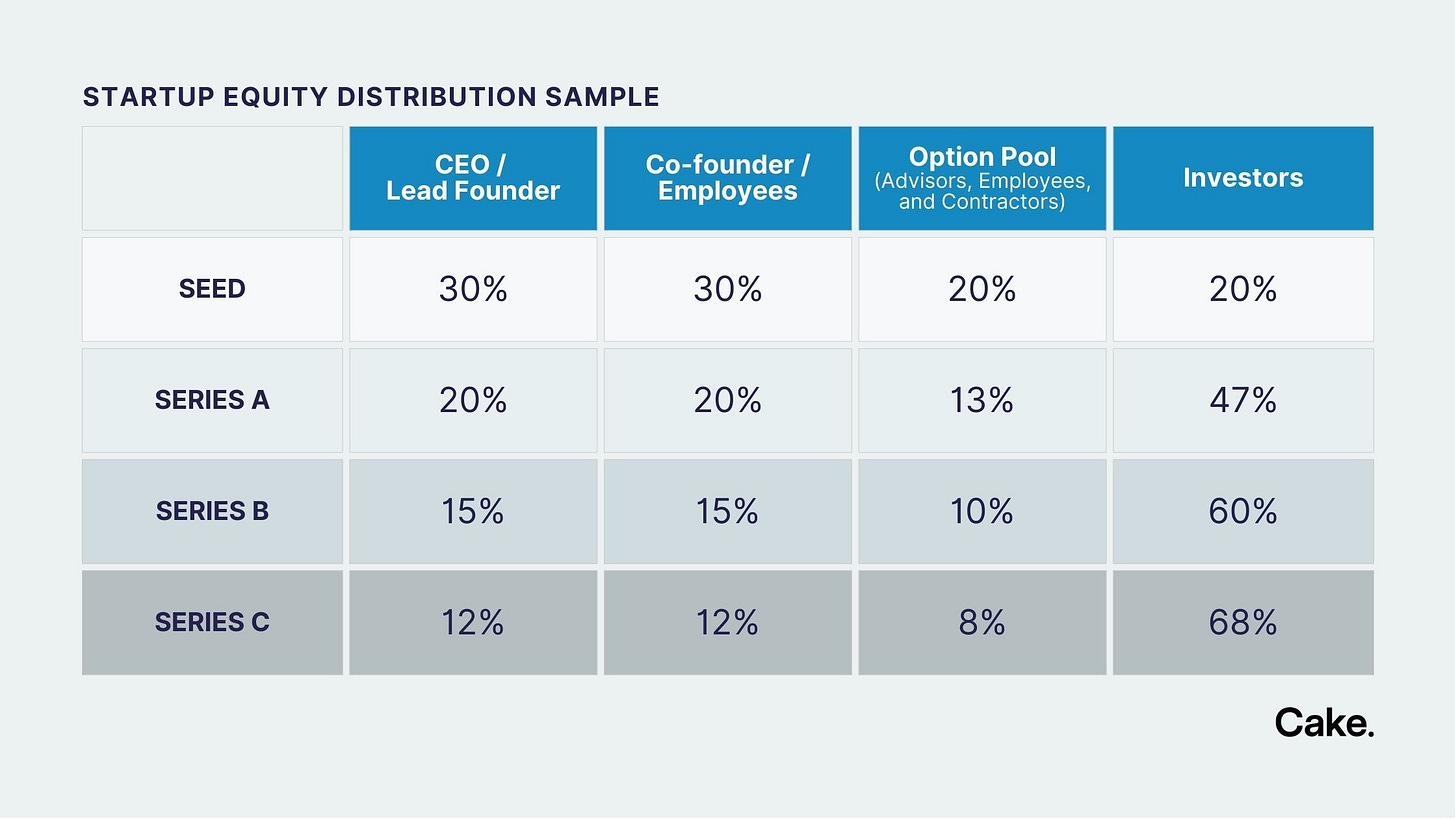

Effective equity distribution depends largely on a company’s stage of growth. The table below offers a standard reference for how equity is typically divided among stakeholders as startups progress through funding rounds. It’s crucial to adapt these benchmarks to your unique circumstances while maintaining a consistent equity-sharing plan.

Different Forms of Startup Equity

Startups leverage a range of equity types to suit different growth stages and business needs. These include Common Stock, Preferred Stock, Restricted Stock, RSUs, and Stock Options or Option Pools. Each category is defined by distinct features that help startups balance ownership, reward employees, and secure investment.

Common Stock

Issued to: Founders and employees.

Key Characteristics: Represents ownership but typically lacks special privileges.

Voting Rights: Yes.

Conversion & Liquidation: Usually no specific benefits.

Preferred Stock

Issued to: Investors.

Key Characteristics: Comes with privileges such as dividends, anti-dilution rights, and liquidation preferences.

Voting Rights: No (unless stated).

Liquidation Priority: Higher than common stock.

Restricted Stock Units (RSUs)

Issued to: Employees as a deferred form of equity.

Key Characteristics: Vesting required before ownership, often granted without purchase requirements.

Voting Rights & Dividends: Only if converted into common stock.

Conversion Rights: May vary by terms.

If you're building a business, apply to the Xartup Fellowship Program and join a thriving community of 2,400+ founders tackling one of the toughest times in the Indian startup ecosystem.

The Xartup Fellowship has been an incredible journey for its Fellows:

2,400+ Alumni

300+ Startups

$9M+ in Funding Raised by Alumni

Be part of this transformative network driving success in the startup world.

Stock Options & Option Pools

Issued to: Employees and key stakeholders.

Key Characteristics: Right to purchase shares at a predetermined price over time, providing a retention incentive.

Vesting Period: Encourages long-term employee commitment.

Liquidation Rights: Typically, none.

How to Value Startup Equity: A Breakdown

Valuing startup equity is essential for both investors and employees. Different methods can be used depending on various financial factors and future projections. Here’s a breakdown of the four key ways to assess the value of startup equity, inspired by the visual diagram provided:

1. Last Preferred Price

Definition: The most recent valuation per share paid by investors during the latest funding round.

Why It Matters: This is a strong indicator of the startup’s current market valuation and investor confidence.

Example: If investors paid $100 per share in Series B, that becomes the benchmark for calculating equity value.

2. Post-Money Valuation

Definition: The total company valuation immediately following a new funding round, including the newly raised capital.

Why It Matters: It reflects the company’s value after accounting for the injection of investor funds.

Example: A startup raises $10 million on a pre-money valuation of $50 million, making the post-money valuation $60 million.

3. Strike Price

Definition: The set price at which employees or investors can purchase shares under a stock option agreement.

Why It Matters: It determines the potential profitability of exercising stock options.

Example: If your strike price is $5 per share and the market value rises to $15 per share, the $10 difference represents your potential gain per share.

4. Hypothetical Exit Value

Definition: An estimate of the company’s worth if it were to go public or be acquired.

Why It Matters: This helps in forecasting potential returns during an exit event, crucial for early investors and option holders.

Example: If a company estimates a $200 million valuation during a potential IPO, stakeholders can gauge the potential returns on their equity.

Each of these methods helps startups and stakeholders understand the tangible and future value of equity, facilitating better investment and compensation decisions.

As a founder, if you're looking to understand and calculate your startup's equity dilution, this is the ultimate tool for you: Startup Equity Dilution Calculator

Conclusion

Issuing equity is a balancing act that can make or break your startup’s journey. Proper planning, clear communication, and strategic allocation are key to building a motivated team and securing the right investors.

Start building your equity strategy today to set the foundation for long-term success.

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2,400+ Alumni

300+ Startups

$9M+ in Funding Raised by Alumni

Be part of this transformative network driving success in the startup world.