How Reddit Got Idea-Stage Fundraising Right

How Reddit raised money without writing a line of code. Learn the formula to pitch ideas, not just products.

How Xartup Helps You Fundraise Smarter

Instead of blindly reaching out to investors, use a strategic approach:

✅ Leverage Xartup’s Investor Database to find the right VCs based on sector & stage.

✅ Join the Xartup Fellowship to access mentorship & growth resources.

✅ Get Technical Credits to test your product and many more.

🚀 Ready to optimize your fundraising? Join xartup.com

“Investors only fund startups with traction, right?”

That’s what most founders believe—until they meet investors who’ve funded 28 startups just based on an idea. No product. No revenue. No traction. Just clarity.

One such investor recently shared this thought:

“Traction is overrated. I fund startups when the founder shows me, they deeply understand a problem—and why their solution is the one that wins.”

But some of the most iconic startups—including Reddit—secured funding when they were just an idea on paper.

Yes, before Reddit had millions of daily users…

Before it became the “front page of the internet” …

It raised its first check without writing a single line of code.

So, what did it actually take?

Let’s break this down.

About Reddit?

In short Reddit is a social media platform launched in 2005 where users create and join communities (called subreddits) to share news, content, and engage in discussions. It’s known as “the front page of the internet” due to its huge variety of niche communities.

Now the Early Problem Faced by Reddit:

No traction, no product, and no users.

When founders Alexis Ohanian and Steve Huffman pitched Reddit to Y Combinator, they didn’t have a working platform. Just an idea — a site where people could post content, vote on it, and build conversations. The challenge?

There were already forums and blogs, but none offered anonymity + community + real-time discussion in one place.

Now the question is Why Investors Still Said "Yes"

Despite having no product or users, Reddit’s pitch stood out because it addressed a real, evolving behavior on the internet. Blogs were static. Forums were fragmented. People wanted fast, anonymous, community-driven conversations. Reddit identified this gap before anyone else.

Their pitch showed:

A large and growing pain point (forums were outdated).

A clear narrative for how behavior was shifting online.

Confidence in a simple yet scalable solution.

This wasn’t hope—it was insight, structured into a compelling story.

The Power of Structure in Idea-Stage Pitching

What makes an idea fundable isn’t hype—it’s how it’s framed. Reddit nailed this structure:

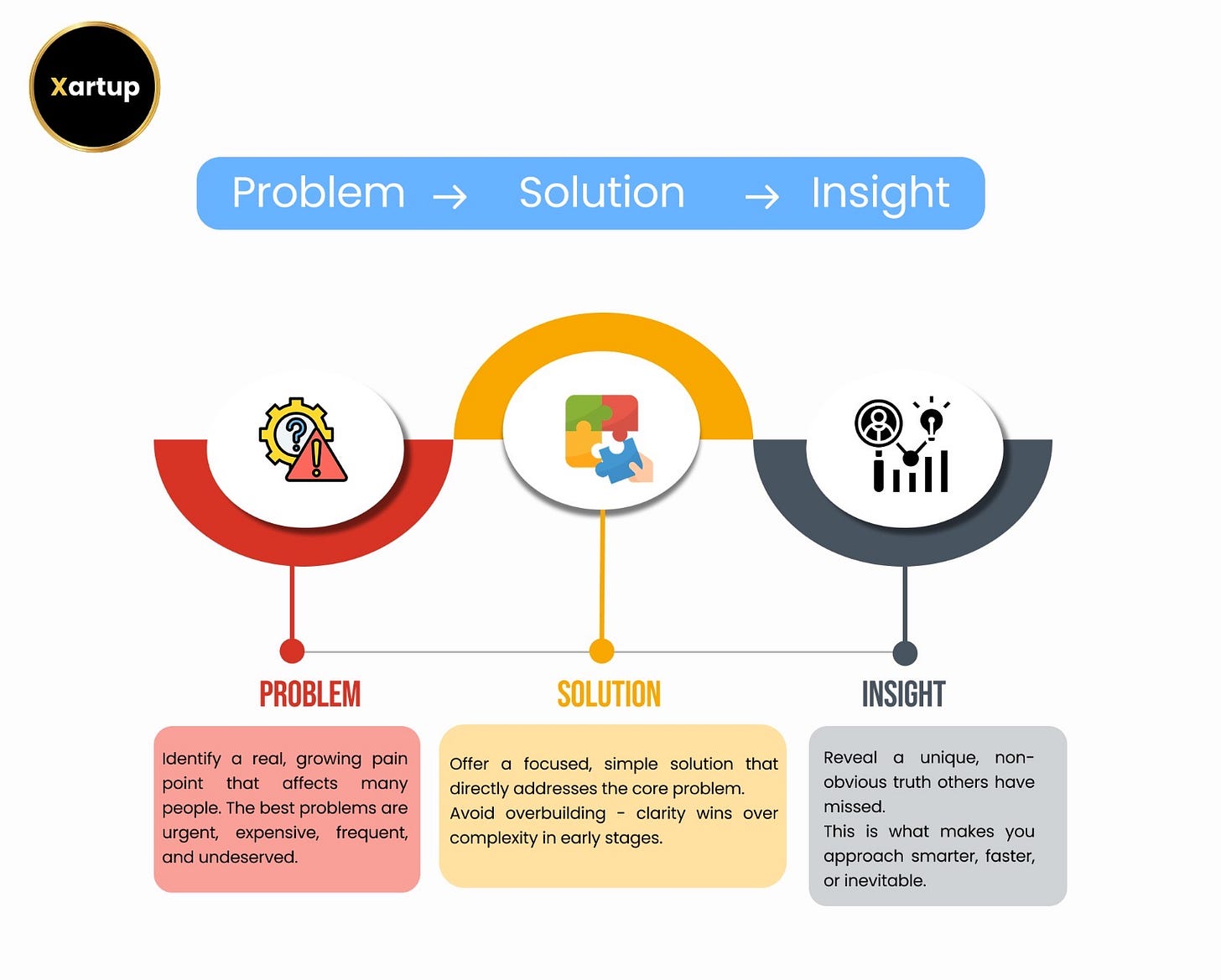

Problem → Solution → Insight

Here’s what that looked like in their case:

1. The Problem: Pick a Fight That’s Worth Winning

Most failed startups solve problems nobody truly cares about. Your job is to find one that hurts.

The best startup problems are:

Popular: Millions face it or will soon.

Growing: The pain is compounding over time.

Urgent: It can’t be ignored any longer.

Expensive: People will pay to get it solved.

Mandatory: Not optional—something has to be done.

Frequent: Happens repeatedly, ideally daily.

💡 VC Hack: Investors love frequency. More usage = more chances to win.

Ask yourself: Is this problem painful enough that people will beg for a solution—or pay to never face it again?

2. The Solution: Don’t Start Here

The biggest mistake? Starting with a cool tech stack and then looking for a problem to wedge it into.

That’s not innovation. That’s noise.

Instead, anchor hard into the problem. Build the simplest solution that solves it directly and clearly.

The early version of your product doesn’t need bells and whistles. It needs to work—and fast.

Avoid: “We’re building an AI-powered X with blockchain for Y.”

Embrace: “We’re solving this one specific pain point, with precision.”

💡 Investor Tip: Great startups are obsessed with the problem, not the tech.

3. The Insight: Your Weapon of Mass Differentiation

This is what separates good founders from fundable ones.

Your insight is the sharp, non-obvious truth you’ve discovered that most haven’t. It’s your unfair edge—and why your solution has to work.

There are 5 types of unfair insight:

Founder Advantage: You’ve lived the problem. Deeply.

Market Advantage: Your space is growing like crazy (20%+ per year).

Product Advantage: You’re not 10% better—you’re 10x better.

Acquisition Advantage: You don’t need to pay Meta to get users.

Monopoly Advantage: Your product gets stronger the more people use it (think: network effects).

💡 Truth: No insight = no differentiation = no investor interest.

The best founders don’t just spot market gaps—they know something true, before it’s obvious to everyone else.

Xartup, in collaboration with VCCircle and IIT Bombay, is excited to present the 1st chapter of The Pitch FY 25-26 – India’s leading fundraising platform for startups.

Building on the success of 4 impactful chapters in FY 24-25, where over 170 startups pitched to 60+ investors, The Pitch now moves to Mumbai.

Don’t miss out on this exclusive opportunity to pitch your startup one-on-one to India’s top investors at IIT Bombay on 6th June 2025.

Apply now and take the next step towards raising capital and scaling your business!

Here’s the Next Move for Founders

Startups don’t get funded because they’re loud.

They get funded because they’re clear.

The best investors aren’t waiting for traction.

They’re hunting for founders who see the world differently—and can explain why their solution must exist.

So, if you’re early, don’t panic. You don’t need 10,000 users or an MVP yet.

What do you need?

Clarity. Structure. Insight.

Nail those—and you won’t just get funding. You’ll earn conviction.

Further Reading & Listening for Founders

📘 Books

The Mom Test by Rob Fitzpatrick – How to talk to users and validate problems without bias.

The Lean Startup by Eric Ries – Learn to iterate fast with minimal resources.

🎙️ Podcasts

Invest Like the Best – Interviews with top investors on what makes startups stand out.

The Twenty Minute VC – VC insights, especially around early-stage fundraising.

🎥 Videos

How Xartup Helps You Fundraise Smarter

Instead of blindly reaching out to investors, use a strategic approach:

✅ Leverage Xartup’s Investor Database to find the right VCs based on sector & stage.

✅ Join the Xartup Fellowship to access mentorship & growth resources.

✅ Get Technical Credits to test your product and many more.

🚀 Ready to optimize your fundraising? Join xartup.com