How to Approach Investors: A Step-by-Step Guide for Early-Stage Founders

Mastering Investor Conversations to Secure Your First Funding Round

Check out the cold email that helped Factmata's founder secure $1M from Mark Cuban and the founders of Twitter, Zynga, and Craigslist, plus other winning email samples revealed at the end of this article 👇

Picture this: you’ve poured your heart and soul into your startup, and now it's time to share your vision with potential investors. The stakes are high, but you’re not just selling an idea; you’re inviting them to be part of your journey. How do you capture their interest and make a lasting impression?

In this guide, we'll break down the process of approaching investors in a way that feels doable, starting from researching the right people to making a memorable first impression. Ready to secure that investment and turn your startup dream into a success story? Let’s dive in!

Step 1: Finding the Right Investors

The first step in approaching investors is knowing who they are. Not all investors are the same—some specialize in specific sectors, while others focus on different stages of funding. Your goal is to identify investors whose portfolios align with your industry and growth stage.

Check Out: Complete Investor List for Startup Fundraising

Step 2: Where to Meet Your Potential Investor

- Warm Approach

One of the most effective ways to connect with investors is through personal interaction at the right events. Seek out gatherings where investors are present but other founders aren’t pitching—events like luxury real estate summits, yacht shows, or major sports events like the U.S. Open. These low-pressure environments offer natural opportunities to build relationships without the competition of other startups. Multi-day events are particularly useful for creating rapport before you even discuss your business.

- Cold Approach

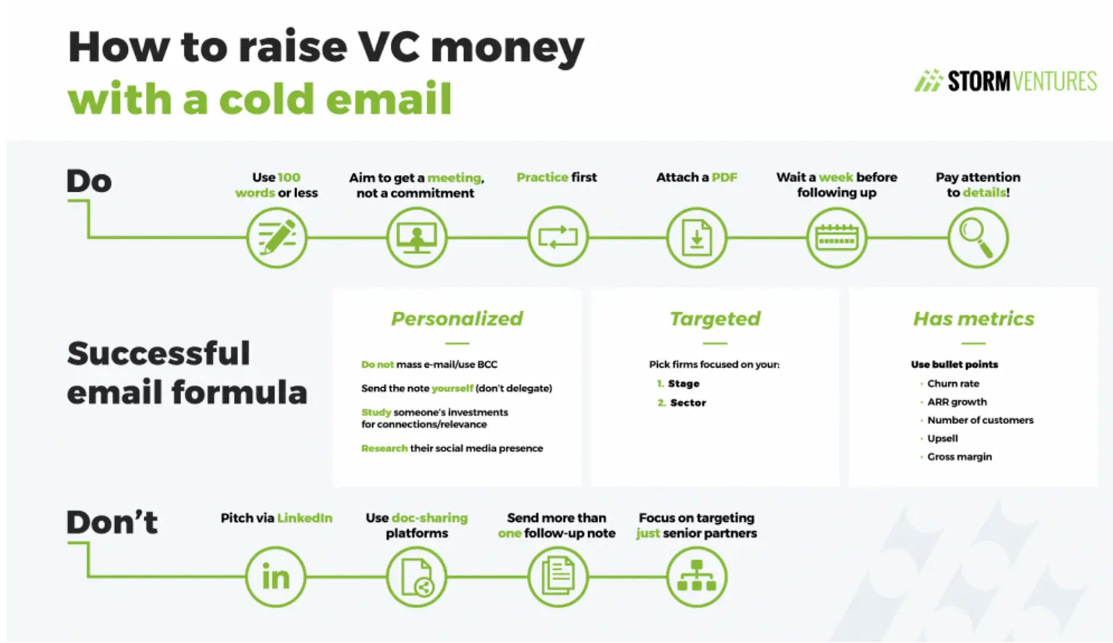

When face-to-face networking isn't an option, the digital route is the next best thing. Try for a warm introduction through LinkedIn or a mutual connection—it boosts your chances of getting noticed. If that’s not possible, you can still reach out cold via email, investor websites, or social media. Keep your outreach concise, professional, and demonstrate that you’ve researched the investor thoroughly. Show why you’re worth their attention, even if you’re approaching them from scratch.

Step 3: What to talk about in your first conversation

- Know Your Investor Like a Friend

Before reaching out to an investor, take the time to know them as if they were a close relative. Research their background, personal interests, and involvement in activities like sports, arts, or charitable work. This helps you approach them as more than just a business pitch—it's about building a genuine human connection. Respect their privacy, but use publicly available information to tailor your conversations in a way that resonates with their personal values and interests.

- Create FOMO Around Your Industry

When you first engage with a potential investor, steer the conversation toward topics they care about. This builds rapport and sets a friendly tone for future discussions. In your second interaction, subtly introduce your industry, creating a Fear of Missing Out (FOMO). Instead of pushing your startup, share exciting stories, innovations, and trends. Let your enthusiasm for the industry spark their interest, and they'll be eager to learn more about the opportunities it presents. If everything goes well, there will be another meeting, and finally you can talk about your business.

Step 4: The Essential Details—Creating an Investor-Ready Pitch

Once you've built a connection, it's time to get specific. Your pitch should be clear, concise, and memorable. According to Bussgang’s framework in Launching Tech Ventures, here are the essential elements:

Who You Are: Introduce yourself, explain why you're seeking funding, and emphasize your founder-market fit.

Customer Pain Point: Clearly define the problem your product addresses.

Solution Overview: Highlight how your solution stands out from the competition.

Market Size: Back up your claims with research on TAM, SAM, and SOM.

Competitive Advantage: Explain what sets you apart from others in the market.

Customer Acquisition Plan: Outline your go-to-market strategy.

Revenue Streams: Explain your business model and how it ensures profitability.

Financial Outlook: Provide realistic financial projections.

The Ask: Specify the amount of funding you need and outline the milestones it will help you achieve.

Be prepared to discuss key milestones and experiments you’ll run with the funding. Investors expect clarity on how their money will drive growth.

Check Out: Successful startup pitch decks

Step 5: Wrap up with the Exit Plan in your Pitch deck

While your business may still be young, investors are keen to understand how they’ll eventually profit.

As Bussgang explains in Launching Tech Ventures, “VC firms are professional investors with a clear goal: maximize returns for their limited partners while balancing their duties to both the investors and the company."

To close your pitch effectively, be sure to outline your exit strategy and the potential paths for investors to cash out.

Step 6: Following Up with Investors

After your initial pitch, it's crucial to maintain momentum. Investors receive numerous pitches, so following up is key to keeping yours top of mind. Send a thank-you email, briefly summarizing key points from your discussion and offering any additional information they might have requested. Stay professional, but persistent—regular updates on your progress or new developments can help keep investors engaged.

To sum up, above are some of the steps that you can follow to make a good impression on the investors and you’ll be well on your way to securing the support needed to propel your startup to success. Remember, building relationships is key—investors want to feel connected to you and your vision.

Funding-winning Email Samples of Founders

Here are some resources to help you raise funds without any warm connections—just through cold outreach:

Mapistry’s CEO secured $2.5M seed round via cold email

Dhruv Ghulati, CEO of Factmata raised $1M by cold email

Cold email examples sent to VCs

Even Billionaires send cold emails

Investor Outreach Templates for Early Stage Founders

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$9M+ in funding raised by Alumni