Inside the VC Mind: How Venture Capitalists Really Make Investment Decisions

Decoding the criteria and methods top VCs use to select high-potential startups

Check out the list of top VCs, their notable investments and their application link in the end 👇🏻

The venture capital world can feel like a mystery to founders trying to secure funding. VC firms receive thousands of pitches, but only a small fraction make it through. So, how do they choose?

In this guide, we’re peeling back the curtain on how venture capitalists truly make decisions. From assessing founder potential to market viability, we’ll uncover the exact strategies and hidden factors VCs consider before committing to a deal. Ready to get inside the VC mind and set yourself up for success? Let’s dive in!

Below are the top factors that venture capitalists consider before investing in a startup, each step summarized in the form of an infographic sourced from Chris Tottmann:

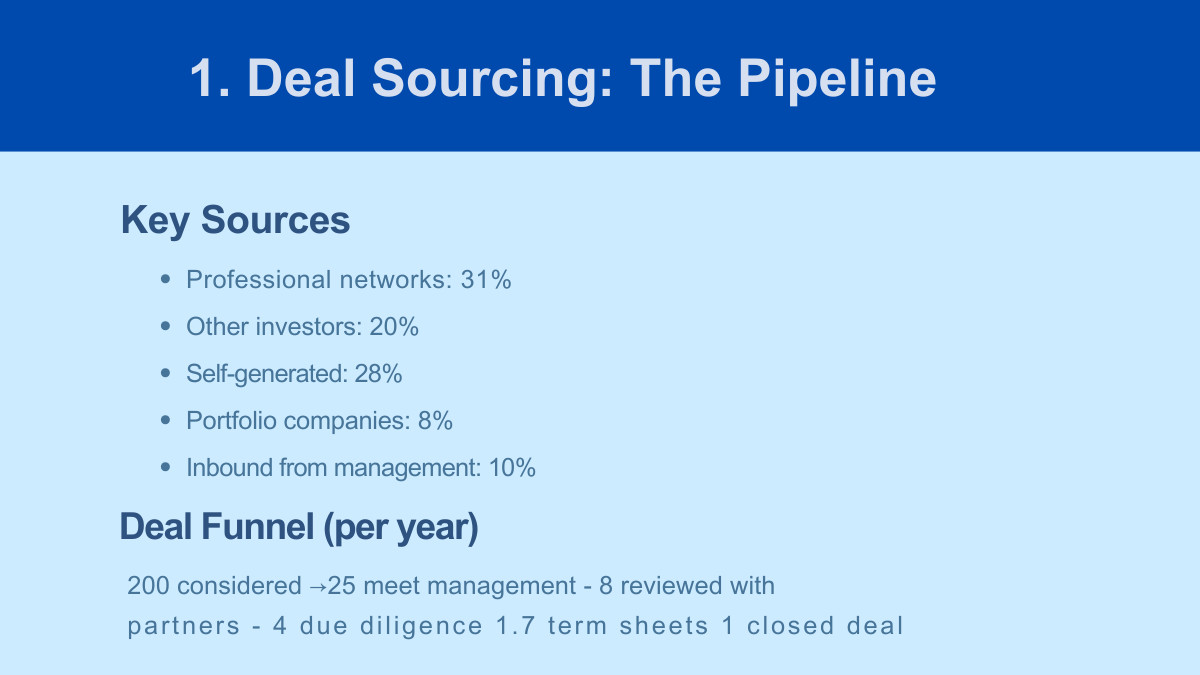

1. How do VCs source deals (Deal Pipeline)?

Deal sourcing is the first step in any VC’s journey. Rather than stumbling on startups by chance, VCs build extensive networks that continuously generate high-potential leads.

Primary Sources: Professional networks (31%) provide most deals, thanks to relationships with industry veterans like former entrepreneurs, other VCs, and advisors. Other investors account for 20%, while self-sourced leads and management-initiated pitches make up the rest.

The Deal Funnel: Out of hundreds of prospects, only a handful advance through the rigorous selection process to due diligence and finally investment. This funnel highlights the importance of a strong pitch.

2. What factors do VCs consider before investing in a startup?

Once a deal is sourced, VCs turn to evaluating startups with potential. This selection isn’t random; it’s a thorough assessment based on critical factors that could make or break the venture.

Primary Considerations: Top priority is the management team (59%). VCs seek resilient, visionary founders with relevant experience and a proven track record. Market potential (51%) follows closely, as VCs favor businesses with scalability and large market opportunities. Product differentiation (40%) is also vital—unique solutions with strong market demand stand out in a competitive landscape.

Due Diligence Steps: During due diligence, VCs dive into financials, validate founders' claims, and consult with customers or experts. This process ensures that the opportunity is aligned with VC criteria and has long-term potential.

3. How VCs assess a startup's valuation or worth?

Valuation is more than a dollar figure; it's a calculated mix of risk and opportunity. VCs aim to invest at a fair price that aligns with a startup's future potential.

Key Metrics: VCs rely on both numbers and insights. The anticipated exit value (46%)—whether the company can go public or be acquired—is a major consideration. They also look at comparable companies (29%) to benchmark against similar investments.

Financial Metrics: Cash-on-cash multiple (63%) is commonly used to gauge returns, offering a straightforward view of profitability. A strong IRR (internal rate of return) is another priority, signaling efficient capital use. VCs approach valuations with caution, focused on maximizing returns.

4. How VCs evaluate future growth of a startup (Forecasting)?

Though predicting growth is difficult, VCs rely on forecasts to inform their investment strategies. The focus is on estimating a startup’s cash flow and overall potential.

Expected Timelines: Typically, VCs anticipate seeing substantial returns within 3-4 years. However, early-stage investments bring high uncertainty, with only around 20% of forecasts proving accurate.

Need for Realistic Goals: Ambitious numbers may look impressive, but over-the-top projections can raise red flags. VCs favor realistic, data-backed forecasts that reflect a founder’s understanding of market dynamics. Reliable projections build trust, while overly optimistic ones can detract from credibility.

Join the biggest Post Exit Founders Virtual Conf on Nov 6th, co-hosted by the 2,500+ PEF community.

If you’re a founder (both exited or not) or an investor, you can join Zoom or YouTube stream to learn from peers and network.

5. What is the deal structure to protect VC interests?

With a deal moving forward, defining terms protects VCs’ stakes and ensures alignment with the startup’s growth goals.

Commonly Used Terms: Pro-rata rights (81%) allow VCs to retain their equity in subsequent funding rounds. Liquidation preferences (75%) prioritize return in exit events, while redemption rights (45%) provide an exit strategy if goals aren’t met.

Balancing Flexibility and Security: From flexible to stringent, deal structures reflect the risk level. Redemption rights and anti-dilution provisions offer more protection, while pro-rata rights allow some flexibility. VCs adapt terms based on the specifics of each investment opportunity.

6. Why do VCs go for syndication?

Syndication is a way for VCs to share risk and pool resources. Rather than going it alone, they often collaborate with other firms to back promising startups.

Reasons for Syndication: About 65% of deals are syndicated, with capital constraints being the top reason. By teaming up, VCs can access larger opportunities and leverage each other’s networks. This collaboration enables a smoother flow of resources and support for the startup.

Choosing Partners: Selecting syndication partners is strategic. VCs prefer partners with complementary expertise or those with successful track records in the same industry. This adds value to the startup and increases its chances of success.

7. How VCs add value to the startup beyond capital?

Money alone isn’t enough for growth. Many VCs go beyond funding to support their portfolio companies, making post-investment value-add an essential part of their role.

Types of Support: VCs offer a range of value-add services, with strategic guidance (87%) and operational guidance (65%) being the most common. They also connect startups with investors, potential customers, and advisors. This network access can be invaluable, especially for startups looking to scale rapidly.

Building Long-Term Relationships: VCs aim to be more than investors; they strive to be strategic partners. By actively engaging with their portfolio companies, they help shape the path to success, which in turn strengthens their own reputation in the industry.

8. How VCs expect return through exit?

Exits are the finish line for VCs, enabling them to cash in on their investments through acquisitions, IPOs, or other means.

Primary Exit Strategies: Acquisitions (53%) lead in frequency, providing a reliable return path, while IPOs (15%) offer higher potential rewards but carry more risk. Acquisitions might lack the spotlight, but they deliver more predictable outcomes for VCs.

Typical Returns: Most VCs seek 5x to 10x returns, though only select investments reach this range. Losses are expected, but VCs rely on a few high-performing investments to balance the overall portfolio.

Popular VCs, their notable investments & application link

To help founders connect with the right VCs, here are some top 10 firms:

Sequoia Capital

Notable Investments: Apple, Google, Airbnb, Zoom.

Application Link: Sequoia Capital

Accel Partners

Notable Investments: Facebook, Slack, Spotify, Atlassian.

Application Link: Accel Partners

Andreessen Horowitz

Notable Investments: Facebook, Slack, Twitter, Coinbase.

Application Link: Andreessen Horowitz

Greylock Partners

Notable Investments: LinkedIn, Airbnb, Facebook, Dropbox.

Application Link: Greylock Partners

Benchmark Capital

Notable Investments: eBay, Twitter, Uber, Instagram.

Application Link: Benchmark Capital

Index Ventures

Notable Investments: Dropbox, Skype, Adyen, SoundCloud.

Application Link: Index Ventures

Bessemer Venture Partners

Notable Investments: LinkedIn, Shopify, Twilio, Pinterest.

Application Link: Bessemer Venture Partners

Foundry Group

Notable Investments: Fitbit, SendGrid, Joby Aviation, Zayo.

Application Link: Foundry Group

Union Square Ventures

Notable Investments: Twitter, Etsy, Tumblr, Coinbase.

Application Link: Union Square Ventures

Lightspeed Venture Partners

Notable Investments: Snapchat, Nest, Grubhub, MuleSoft.

Application Link: Lightspeed Ventures

Conclusion

Understanding how VCs make decisions can help founders present themselves as attractive investment opportunities. By grasping the nuances of deal sourcing, selection criteria, valuation, and post-investment support, startups can better align their pitches with what VCs seek. Ultimately, the VC ecosystem is built on trust, growth, and a shared vision for creating disruptive solutions.

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$5M+ in funding raised by Alumni