Investor's Favorite Valuation Method: The VC Method

Everything You Need to Know About Valuation, Pitching, and Winning Over Investors

In one of our previous newsletter, we explored the various types of valuation methods used by investors. Among them, the VC Method stands out as a favorite for early-stage startups. This approach resonates with investors who are looking to assess future growth and exit potential rather than just focusing on current metrics.

Today, we’re going to take a deeper dive into the VC Method—what it is, how it works, and why it’s the go-to method for venture capitalists. Whether you’re preparing for your first pitch or refining your fundraising strategy, this guide will equip you with the tools to approach investors with confidence.

What is the VC Method?

The Venture Capital Method is a simple yet powerful valuation technique often used by VCs to assess early-stage companies. Unlike traditional valuation methods that rely on current financials, the VC Method focuses on projecting future growth and the potential for a profitable exit.

It’s about looking forward: What is your company going to be worth in 3-5 years, and how much will it make for the investors once they exit?

The 6-Step VC Valuation Process

1. Determine the Required Capital for Investment

Before anything else, you must determine how much capital you need to raise for your startup. This is the amount that will help you grow and reach the stage where investors can expect a return.

Example:

Let’s assume your startup is seeking $8 million in its Series A round to fund product development, marketing, and scaling operations. This is the amount you’ll need to raise to take the company to the next level.

2. Project the Startup’s Financial Performance

Next, you need to project your startup’s financials over the next 3-5 years. This typically includes revenue projections, profit margins, and operational costs. Forecasting allows you to demonstrate to investors that your business will scale and reach a point of profitability.

Example:

Your startup is projecting $100 million in revenue and $10 million in profit by Year 5. These figures are based on the growth potential in the market and expected market share. Investors want to see that your business is capable of generating significant revenue and profits within a reasonable timeframe.

3. Define the Exit Strategy and Timeline

VCs generally aim to exit their investment after 3-7 years, usually through an IPO (Initial Public Offering) or an M&A (Merger & Acquisition). You need to specify when and how you anticipate this exit will happen to provide clarity on the return timeline.

Example:

For your startup, the VC firm plans to exit in 5 years. The goal is to sell the company through an acquisition (M&A) or take it public through an IPO. This is critical for calculating the company’s value at the time of exit and for providing investors with a realistic timeline for liquidity.

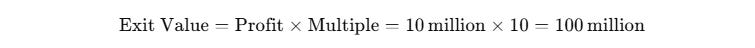

4. Calculate the Exit Multiple Using Comparable Companies

The exit multiple is the valuation of your company at the time of exit. This multiple is often based on comparable companies in your industry (comps) or other metrics like earnings, revenue, or EBITDA. You multiply your projected financials (like profits) by the exit multiple to determine the potential exit value of your company.

Example:

Let’s say your startup is expected to have $10 million in profit by Year 5, and similar companies are being sold for 10x earnings (the exit multiple). The exit value of your company would be:

This means the potential value of your startup at the time of exit will be $100 million.

5. Apply a Discount Rate to Calculate Present Value

Next, you need to account for the time value of money and the risk associated with your business. The discount rate is applied to the future exit value to calculate the present value (PV) of your company. Venture capitalists typically expect a high rate of return, often 30% or more, given the high risk of investing in early-stage companies.

Example:

The VC firm is targeting a 30% annual return on its investment. To calculate the present value (PV) of the exit value, you apply the 30% discount rate over the 5-year period.

This means that the present value of your startup, based on a $100 million exit value, is $27 million.

6. Calculate Pre-money Valuation and Investor Ownership

Now that you know the present value of your startup, you can calculate your pre-money valuation (the value of the company before the investment). You can also determine the ownership stake that investors will get based on their investment amount.

Example:

Your startup is raising $8 million in funding, and the present value is $27 million. To determine the pre-money valuation:

To calculate the ownership stake the VC will get:

This means that after investing $8 million, the VC will own 30% of your startup.

Lesson for a Founder

As a founder, the VC Method is a critical tool for understanding how investors view your company and what they expect in terms of growth and return on investment. The method helps you set clear expectations for both yourself and your investors.

Focus on creating a scalable, profitable business with strong future growth potential. By clearly understanding and applying the VC Method, you’ll be able to communicate your startup’s value to investors effectively and set realistic expectations for your funding round.

Resources to Learn More

For a deeper dive into the VC Method, here are some resources that will help:

Book: Venture Deals: Be Smarter Than Your Lawyer and Venture Capitalist by Brad Feld & Jason Mendelson

Article: Venture Capital Valuation Method

How Xartup Helps You Fundraise Smarter

Instead of blindly reaching out to investors, use a strategic approach:

✅ Leverage Xartup’s Investor Database to find the right VCs based on sector & stage.

✅ Join the Xartup Fellowship to access mentorship & growth resources.

✅ Get Technical Credits to test your product and many more.

🚀 Ready to optimize your fundraising? Join xartup.com