Decoding Term Sheets for Startup Success

A founder’s guide to understanding, negotiating, and mastering term sheets — plus free templates from Y Combinator and more

Term sheets are a critical milestone in the fundraising journey, outlining the key terms and conditions of an investor’s proposal. For early-stage founders, understanding this document can mean the difference between a successful partnership and potential pitfalls.

This newsletter demystifies term sheets, breaking down their components, common pitfalls, and best practices, so you can confidently navigate this vital step in securing funding for your startup.

What is a Term Sheet?

A term sheet is a non-binding document that outlines the key terms and conditions of an investment agreement between a startup and an investor. It sets the foundation for negotiations and helps both parties align on expectations before finalizing legal agreements.

Key Components of a Term Sheet

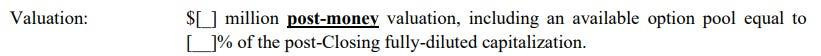

1. Valuation Terms

Pre-Money Valuation:

This represents the company’s valuation before receiving the investment. It determines the percentage of equity the investor will own. For example, if your pre-money valuation is ₹50 crore and an investor puts in ₹10 crore, the post-money valuation will be ₹60 crore, and the investor will own 16.67% of the company (₹10 crore/₹60 crore).Post-Money Valuation:

This is the value of the company after the investment has been made. It’s simply the pre-money valuation plus the investment amount.

2. Investment Amount

This is the total capital the investor is committing to invest in exchange for equity. It also specifies how and when the funds will be provided (e.g., a lump sum or in tranches tied to milestones).

3. Equity Stake

Refers to the percentage of ownership the investor will hold after the investment. This is directly linked to the valuation and the investment amount.

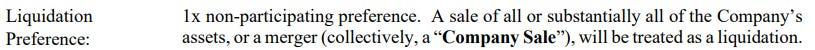

4. Liquidation Preference

Definition: Specifies the order of payouts in case the company is liquidated or sold.

Types:

1x Liquidation Preference: Investor gets their investment amount back before anyone else.

Participating Preference: Investor gets their money back plus shares in the remaining proceeds.

Non-Participating Preference: Investor chooses between getting their money back or a share of the proceeds.

Example: If an investor has a 1x participating liquidation preference on a ₹10 crore investment and the company is sold for ₹50 crore, they would get ₹10 crore first and then a share of the remaining ₹40 crore.

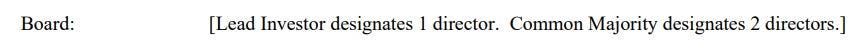

5. Board Composition

Outlines how the board of directors will be structured post-investment. Investors may ask for board seats or observer rights to participate in major decisions, ensuring their interests are represented.

6. Anti-Dilution Provisions

Protects investors in case the company raises a future funding round at a lower valuation (a down round).

Weighted Average Anti-Dilution: Adjusts the investor's ownership proportionally.

Full Ratchet Anti-Dilution: Adjusts the investor's price per share to match the lower valuation completely.

Founders, this is your final chance to secure funding from top investors at The Pitch, India’s premier fundraising-focused pitching platform, happening on December 7th at IIM Calcutta in collaboration with Xartup and VCCircle. Don’t miss this exclusive opportunity to present your startup one-on-one to industry-leading investors, connect with experts, and gain invaluable visibility.

All pitching startups will also become part of the Xartup Community—a growing network of 2500+ founders—and gain access to the Xartup Fellowship Program (valued at ₹10,000) to accelerate their growth journey. Spots are filling fast—register now to take your startup to the next level!

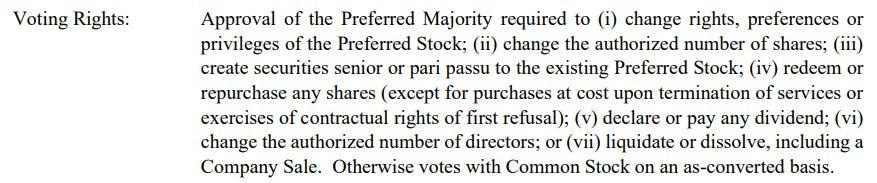

7. Voting Rights

Investors often require special voting rights on significant business decisions, such as mergers, issuing new shares, or appointing key executives. This can dilute founders' control over certain aspects of the company.

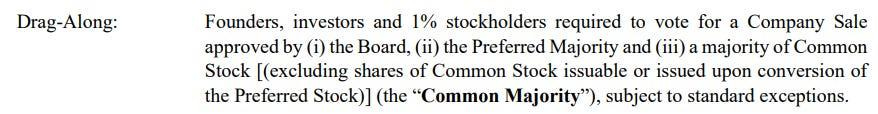

8. Drag-Along and Tag-Along Rights

Drag-Along Rights: Allow majority shareholders to force minority shareholders to sell their stakes during an acquisition.

Tag-Along Rights: Protect minority shareholders by allowing them to sell their shares if a major shareholder exits.

9. Exit Clauses

Define scenarios where investors can exit the investment, such as IPOs, mergers, or buybacks.

May include a put option, giving the investor the right to sell their shares back to the company or other shareholders after a specified period.

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$9M+ in funding raised by Alumni

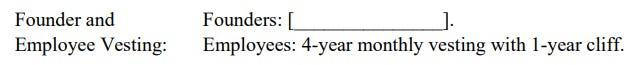

10. Founders’ Vesting and Lock-In Periods

Vesting: Investors may require founders to earn their shares over time, incentivizing long-term commitment. For instance, a four-year vesting schedule with a one-year cliff means a founder earns 25% of their shares after one year, then the remaining monthly over the next three years.

Lock-In Period: Restricts founders or other shareholders from selling their shares for a defined period.

11. Rights of First Refusal (ROFR) and Pre-Emptive Rights

ROFR: Gives investors the first option to purchase shares being sold by existing shareholders.

Pre-Emptive Rights: Allow investors to maintain their ownership percentage by participating in future funding rounds.

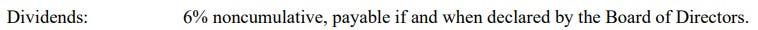

12. Dividends

Investors may negotiate dividend terms. Most startups operate on a non-cumulative dividend basis, meaning dividends are paid only when declared by the board.

14. Conversion Rights

Outline how and when investors can convert their preferred shares into common equity.

15. Confidentiality and Exclusivity Clauses

Confidentiality: Ensures both parties keep the details of the term sheet and negotiations private.

Exclusivity: Prevents the startup from negotiating with other investors for a certain period.

16. Conditions Precedent

Lists specific actions or conditions that the startup must fulfill before the investment is finalized, such as clearing legal disputes, conducting due diligence, or achieving specific milestones.

Most Common Term Sheet Pitfalls Founders Should Avoid

Negotiating a term sheet is a critical step in securing funding, yet many founders fall into avoidable traps. Here are the five most common pitfalls and strategies to steer clear of them:

1. Overlooking Liquidation Preferences

What Happens: Liquidation preferences dictate who gets paid and how much during an exit. Agreeing to harsh terms like 2x or participating preferences without a cap can drastically reduce founder payouts.

Avoid It: Understand the scenarios of different liquidation preferences and negotiate for non-participating preferences or caps on participating preferences to protect your returns.

2. Ignoring Dilution Impact

What Happens: Equity dilution through multiple funding rounds can leave founders with minimal ownership, limiting both financial returns and decision-making power.

Avoid It: Use cap table simulations to evaluate future dilution. Plan for anti-dilution protections and assess how much equity you are willing to give up.

3. Failing to Address Vesting Schedules

What Happens: Vesting schedules that are too restrictive can lock founders into commitments that don’t align with their long-term plans.

Avoid It: Negotiate fair vesting terms, such as a four-year schedule with a one-year cliff. Ensure vesting terms apply equally to all co-founders.

4. Misjudging Control Terms

What Happens: Investors may request veto rights or board seats, reducing founders’ ability to make key decisions independently.

Avoid It: Find a balance between investor oversight and your autonomy. Push for veto rights limited to critical decisions and shared board representation.

5. Skipping Legal and Expert Review

What Happens: Founders who don’t seek legal or expert advice may sign unfavorable terms, overlooking hidden clauses that could hurt the business in the long run.

Avoid It: Engage a legal advisor or an expert familiar with startup investments to review every clause of the term sheet.

By avoiding these pitfalls, founders can safeguard their interests and ensure the terms align with their startup's vision and growth trajectory.

Sample Term Sheet Templates

Here are some sample term sheets to help you get started:

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$9M+ in funding raised by Alumni