Lessons from Steve Jobs’ Fundraising Journey

The Untold Story of Apple’s Early Investors and Jobs’ Relentless Pitching

Steve Jobs’ ability to turn vision into reality was unmatched, and one of the greatest examples is his early fundraising efforts for Apple!

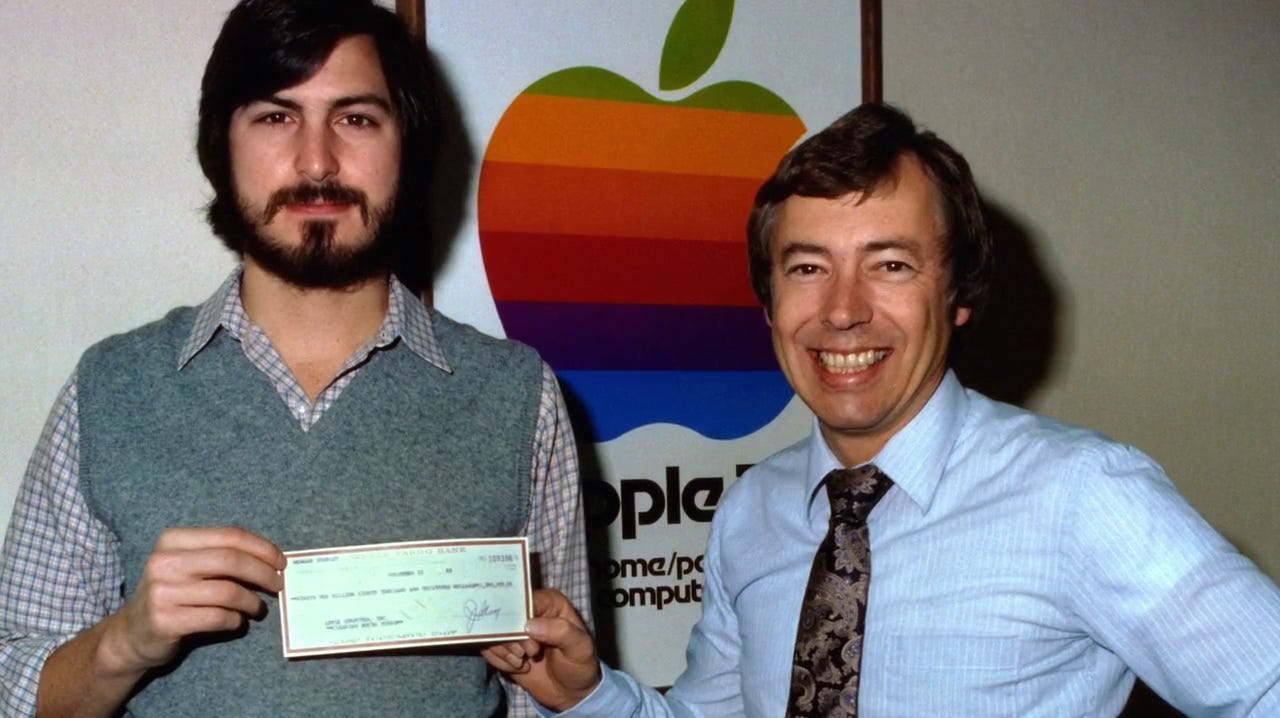

His investor Mike Markkula, who was a millionaire turned after working in Intel, had put who put $250k of his own money in the company in 1977 (roughly equivalent to $1 million of today’s inflation adjusted rate).

In this newsletter, we'll explore the key figures who believed in them and how Jobs' relentless pursuit of funding shaped Apple's initial growth trajectory, taking away learnings for implementing in our own startup journey.

Xartup, in partnership with VCCircle and IIM Calcutta, is thrilled to announce the 2nd edition of The Pitch, India’s premier fundraising-focused pitching platform. Following a successful inaugural edition in Hyderabad, where over 40 pitches were delivered to 17 investors, The Pitch now heads to Kolkata.

Join us at IIM Calcutta on December 7th for a unique opportunity to present your startup one-on-one to investors and turn your momentum into capital.

Jobs’ fundraising marathon: rejections leading to success

Tom Perkins & Eugene Kleiner (Kleiner Perkins)

Despite their legendary status in venture capital, Perkins and Kleiner didn’t even meet with Jobs. They didn’t see the potential and dismissed it outright.Key Learning: Not everyone will understand your vision—keep pushing forward.

Tim Draper (Draper Associates)

Draper rejected Jobs and Wozniak, considering them too arrogant. His judgment was clouded by their personalities, not their product.Key Learning: Confidence may be mistaken for arrogance, but confidence is essential for innovation.

Pitch Johnson

Johnson passed, unable to grasp the idea of a personal computer. He famously asked, “Are you going to put recipes on it?”Key Learning: Just because the market isn’t ready doesn’t mean your idea won’t revolutionize the future.

Stan Veit

Veit declined an offer to buy 10% of Apple for $10,000, doubting Jobs due to his unconventional appearance.Key Learning: Judging by appearances can make you miss billion-dollar opportunities—focus on the vision, not the look.

Nolan Bushnell (Atari)

Bushnell turned down a chance to buy a third of Apple for $50,000 but introduced Jobs to Don Valentine of Sequoia Capital, setting the stage for future investments.Key Learning: Even rejections can open doors if you keep building connections.

Don Valentine (Sequoia Capital)

Valentine wasn’t entirely sold on Jobs but saw enough potential to connect him with Mike Markkula, Apple’s game-changer.Key Learning: Sometimes, it’s not about direct funding but about the right introduction.

Mike Markkula

Markkula believed in Jobs, investing $250,000 for 1/3rd of Apple, and became a pivotal early supporter. His influence extended beyond funding, bringing in marketing expertise and additional investors.Key Learning: Visionary investors don’t just see the present—they see the future.

Regis McKenna & Hank Smith

Markkula convinced McKenna, initially hesitant, to lead Apple’s marketing efforts. He also brought Hank Smith, who invested $300,000 for 10%. Eventually, even Valentine joined in, securing a spot on Apple’s board.Key Learning: Strategic networking can turn skeptics into believers.

If you're building a business, apply to the Xartup Fellowship Program and join a thriving community of 2,400+ founders tackling one of the toughest times in the Indian startup ecosystem.

Valuation Over Time

In its early days, Apple’s valuation stood at approximately $5 million post-Markkula’s investment. By 1980, with the success of the Apple II, Apple’s valuation skyrocketed to $1.8 billion during its initial public offering (IPO). This growth reflects how the initial seed investment enabled Apple to develop groundbreaking products and scale globally.

Conclusion

Steve Jobs' fundraising journey highlights the power of persistence, vision, and strategic partnerships. By securing the right investor in Mike Markkula, Jobs transformed Apple from a garage project into a multi-billion-dollar enterprise. His story remains an inspiration for founders, showing that early fundraising is not just about money—it's about finding partners who share your vision and can propel it forward.

If you're building a business, apply to the Xartup Fellowship Program and join a thriving community of 2,400+ founders tackling one of the toughest times in the Indian startup ecosystem.

The Xartup Fellowship has been an incredible journey for its Fellows:

2,400+ Alumni

300+ Startups

$9M+ in Funding Raised by Alumni

Be part of this transformative network driving success in the startup world.