Startup Valuation Demystified: The Key Steps to Pricing Your Vision

Explore proven key valuation techniques from industry leaders like Hustle Fund, common pitfalls, and discover strategies to secure the right deal for your startup’s growth

Valuing your startup can feel like a puzzle—are you worth $1M, $10M, or more?

In this issue, we’ll demystify the process with insights from Hustle Fund’s approach. Learn the key factors influencing your valuation, such as product development, market size, and team expertise.

Discover effective methods like comparing to similar startups or using the Berkus Method when traction is limited. We’ll also highlight common pitfalls, like overvaluing too soon or giving away too much equity. Whether you’re raising your first round or preparing for the next, this guide will help you set a valuation that attracts investors and aligns with your goals.

Let’s Dive in!

Determining your startup’s valuation can feel like solving a puzzle. Are you worth $1M, $10M, or more? The truth is startup valuations combine hard data, compelling narratives, and investor confidence.

In this issue, we’ll walk you through Hustle Fund’s approach to startup valuations, including key factors that drive value, methods to calculate it, and how to position your startup for success.

Why Valuation Matters

Your startup’s valuation effects:

Equity Ownership: How much of the company you give up.

Investor Appeal: Whether investors see your startup as a worthwhile opportunity.

Future Fundraising Flexibility: How easily you can raise your next round.

Setting the right valuation isn’t just about numbers; it’s about aligning your business goals with market dynamics.

What Influences Your Startup Valuation?

Hustle Fund emphasizes several key factors that investors consider when determining a valuation:

1️⃣ Product Development:

Having an early version of your product, even if it's a basic prototype, demonstrates tangible progress beyond the idea phase. This can positively impact your valuation.

2️⃣ Market Size:

Investors seek startups operating in large, billion-dollar markets, as this indicates substantial growth potential.

3️⃣ Traction and Execution:

Early signs of user engagement, revenue generation, or other performance indicators showcase your ability to execute effectively.

4️⃣ Team Expertise:

A team with relevant experience and deep industry knowledge boosts investor confidence, influencing valuation positively.

5️⃣ Fundraising Capability:

The ability to articulate a compelling vision and attract investment significantly affects valuation outcomes.

The Xartup Fellowship has been an incredible journey for its fellows:

2,500+ Alumni

300+ Startups

$5M+ in Funding Raised by Alumni

Be part of this transformative network driving success in the startup world.

Common Methods to Determine Valuation

1. Comparable Startups

How it works: Compare your startup to others at a similar stage in your industry.

Example: Early-stage SaaS startups with an MVP might have an average valuation of $8M–$12M.

Pro Tip: Calibrate your number carefully by benchmarking against founders with similar experience and traction.

2. Multiply the Amount You’re Raising

How it works: Investors typically want 15%–25% equity in early rounds. Multiply your raise by 4–6 to calculate your valuation range.

Example: Raising $2M? Your valuation range is $8M–$12M.

3. The Berkus Method

How it works: Assign dollar values to key components, like team quality, product progress, and market potential.

Pro Tip: Use this method when you don’t have significant revenue or customer traction yet.

4. Customer Research and Market Fit

How it works: Use mockups, surveys, or beta signups to validate demand and show potential.

Pro Tip: Present data from 20–30 customer interviews or commitments to prove market interest.

Pitfalls to Avoid When Setting Valuation

Raising Too Little at a High Valuation:

Risk: Running out of funds without creating enough value, forcing flat or down rounds.

Tip: Raise enough to reach key milestones for your next round.

Giving Away Too Much Equity:

Risk: Losing control of your company early on.

Tip: Avoid giving away more than 30% in a single round.

Asking for a Too-High Valuation:

Risk: Investors may walk away, and you’ll face pressure to meet unrealistic expectations.

Tip: Keep your valuation within a negotiable range.

Justifying Your Valuation

Leverage Founder Track Record:

If you’ve previously founded successful startups, highlight this to justify a premium valuation.

Highlight Product Traction:

Showcase early product adoption, customer testimonials, or revenue growth.

Customer Research:

Present data from market research, such as mockups or pre-orders, to validate demand.

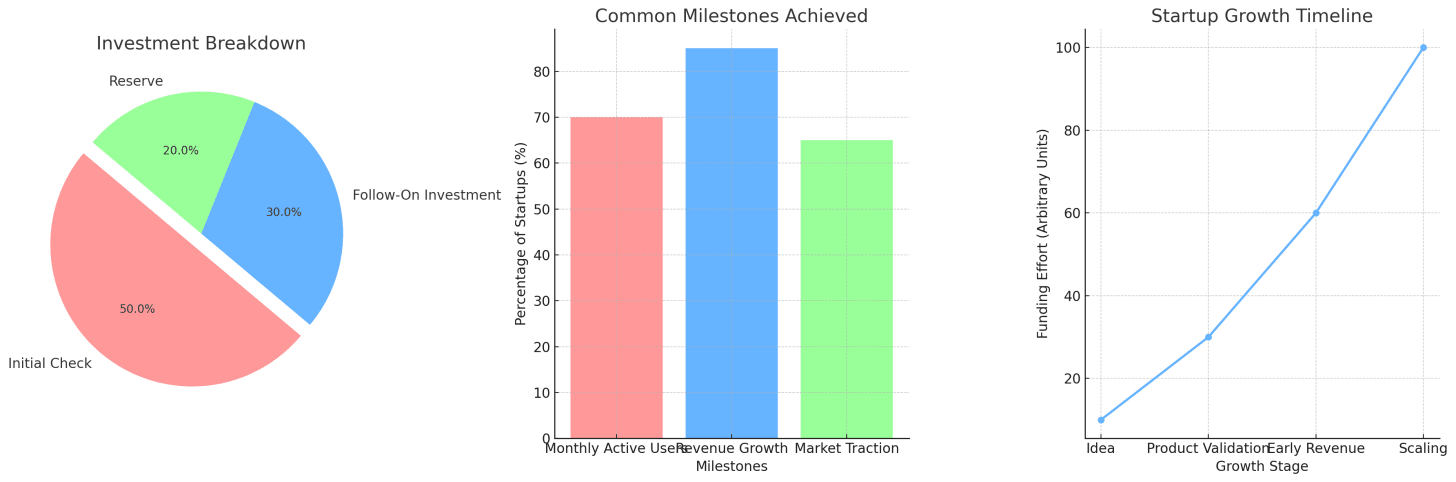

Visualizing Hustle Fund's strategy: investment allocation, key milestones, and the startup journey.

Pro Tips from Hustle Fund

Balance Realism and Optimism: Position your valuation to retain ownership while attracting investors.

Keep a Clean Cap Table: Track ownership and ensure fair equity distribution.

Focus on De-Risking: Prove your business is a smart investment by showcasing milestones and metrics.

Conclusion

Determining your startup’s valuation is both an art and a science. By understanding investor expectations, leveraging proven methods, and showcasing traction, you can set a valuation that aligns with your goals and secures the funding you need.

The Xartup Fellowship has been an incredible journey for its fellows:

2,500+ Alumni

300+ Startups

$5M+ in Funding Raised by Alumni

Be part of this transformative network driving success in the startup world.