The Confidential Sequoia Memo on YouTube: Lessons for Every Founder

Unpacking Sequoia’s game-changing investment memo: Essential insights for startup founders navigating today’s funding landscape

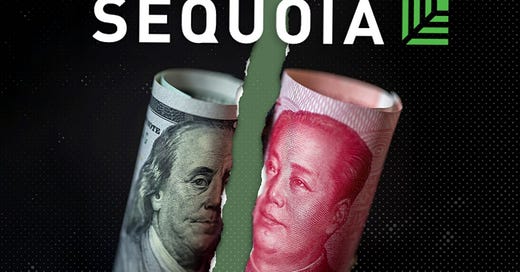

In 2005, Sequoia Capital took a chance on a small, scrappy startup called YouTube, investing $11.5 million for a 30% stake. At the time, YouTube was just an emerging player in the crowded space of online video. Fast forward to today, and it’s one of the most successful acquisitions in tech history, with Google buying YouTube for $1.65 billion just a year later.

The recently leaked Sequoia investment memo reveals exactly what made them believe YouTube was worth the gamble. Let’s dive into the key takeaways from this memo and see how these insights can help you sharpen your pitch and strategy.

1. Founders & Team: Betting on Execution

Memo Excerpt: “We’re investing in the team. The founders’ experience at PayPal gives them the edge to understand rapid user acquisition and monetization strategies.”

Insight for Founders: Investors are not just investing in your idea—they are investing in you. Sequoia’s decision to back YouTube was driven largely by the founders’ track record and their ability to navigate complex tech environments. If you’re pitching to VCs, highlight your team's unique strengths, experience, and ability to execute on your vision.

Founder Actionable Tip: Showcase your past wins, even if they’re outside your current startup. This builds investor confidence in your ability to overcome challenges.

2. Market Potential: Identifying an Inevitable Trend

Memo Excerpt: “The demand for user-generated content is accelerating, and as broadband access improves, we see a massive shift towards video consumption online.”

Insight for Founders: Sequoia wasn’t just investing in what YouTube was at that moment but in what it could become as the market evolved. They predicted the rise of broadband and mobile internet would turn video content into a dominant force.

Founder Actionable Tip: When pitching your startup, articulate the long-term market trend you’re riding. Investors are more likely to bet on companies that are positioned to grow as the market shifts.

3. Product Differentiation: A Frictionless Experience

Memo Excerpt: “YouTube’s ease of use, particularly the seamless upload and sharing experience, gives it a clear advantage over existing platforms.”

Insight for Founders: Sequoia saw that YouTube’s simple user experience—no software downloads or complicated sign-ups—would drive rapid adoption. By lowering the barrier to entry, YouTube was able to quickly scale its user base.

Founder Actionable Tip: Focus on simplifying the user experience. The less friction your product has, the faster users will adopt it. In your pitch, emphasize how your product reduces pain points for your customers.

4. Viral Growth & Network Effects: The Embedding Feature

Memo Excerpt: “The ability to embed videos across other websites will accelerate viral growth, turning users into our most effective marketers.”

Insight for Founders: Sequoia recognized that YouTube’s embedding feature was a game-changer, allowing users to share videos on blogs and social platforms effortlessly. This virality drove exponential user growth with minimal marketing spend.

Founder Actionable Tip: Highlight any viral loops or network effects in your product. Investors love businesses where users become ambassadors, driving organic growth without heavy ad spend.

5. Defensibility: Building a Content Ecosystem

Memo Excerpt: “YouTube’s focus on attracting creators and enabling them to reach wider audiences will create a self-reinforcing content engine.”

Insight for Founders: Rather than just attracting viewers, YouTube focused on creators. By prioritizing their needs, YouTube ensured a steady stream of content, which in turn attracted more users. This flywheel effect made it difficult for competitors to catch up.

Founder Actionable Tip: When pitching, explain how your startup will create a sustainable competitive advantage. Whether it’s building a community, a content ecosystem, or proprietary technology, demonstrate how your business will defend its market position over time.

6. Timing: Betting on a Future Shift

Memo Excerpt: “While current internet speeds are a barrier, we believe that broadband adoption is inevitable. Investing now gives us first-mover advantage.”

Insight for Founders: Sequoia’s memo showed they were willing to bet on future infrastructure improvements, even if the current market wasn’t fully ready. This strategic foresight allowed them to invest early in a company that others overlooked.

Founder Actionable Tip: Timing is crucial. If your startup is ahead of its time, highlight why now is the right moment for your business. Show investors how you’re positioned to capitalize on a coming trend before others catch on.

Xartup, in collaboration with VCCircle and IIM Calcutta, is thrilled to announce the 2nd edition of The Pitch, India’s premier fundraising-focused pitching platform.

After a phenomenal debut in Hyderabad—with over 40 pitches delivered, 17 visionary investors, and nearly 50% of startups attracting investor interest—The Pitch, powered by VCCEdge and in partnership with IIM Calcutta Innovation Park, is now headed to Kolkata!

Join us on December 7th at IIM Calcutta for an exclusive opportunity to present your startup one-on-one to investors, connect with industry leaders, and gain invaluable exposure. Plus, all pitching startups will receive access to the Xartup Fellowship Program (valued at ₹10,000) to accelerate your journey from zero to one.

Explore the full investment memo in detail on YouTube here.

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$9M+ in funding raised by Alumni