Why Every Startup Must Know Unit Economics Before Fundraising

Avoid Costly Pitfalls and Understand your profitability per unit to scale with confidence and avoid financial burn.

Scaling a startup without understanding unit economics is like driving full speed without checking the fuel gauge. Rapid growth might look exciting, but if every new customer costs more than they bring in, your runway shortens fast.

Unit economics defines whether your business is built for long-term success or heading toward financial trouble. By mastering key metrics like LTV, CAC, and margins, you ensure that scaling fuels profitability—not just expansion. Let’s dive into how you can optimize your numbers and build a sustainable, investor-ready startup.

What is Unit Economics?

Simply put, unit economics is a way to measure how profitable your business is on a per-unit basis.

A "unit" can be anything that generates revenue for your business—like a product you sell, a subscription package, or even a single customer. Unit economics helps you understand the relationship between revenue and costs for each unit, but the way you measure it can vary depending on your business model.

The Five Key Factors of Unit Economics

To get a clear picture of your startup’s financial health, focus on these five aspects:

Revenue per unit – How much money do you make per unit sold?

Gross profit per unit – Revenue minus the cost of making or delivering that unit (COGS - Cost of Goods Sold).

Lifetime value of a customer (LTV) – How much profit does a customer bring in over their lifetime?

Customer acquisition cost (CAC) & payback period – How much does it cost to acquire a customer, and how long does it take to break even?

Overall business line profitability – Beyond CAC and COGS, what other costs (like customer support) impact profitability?

How Xartup Helps You Fundraise Smarter

Instead of blindly reaching out to investors, use a strategic approach:

✅ Leverage Xartup’s Investor Database to find the right VCs based on sector & stage.

✅ Join the Xartup Fellowship to access mentorship & growth resources.

✅ Get Technical Credits to test your product and many more.

🚀 Ready to optimize your fundraising? Join xartup.com

Why Unit Economics is Essential for Startups 🚀

Unit economics determines whether your startup can scale profitably, allocate resources efficiently, and align with market demand.

1. Gain a Clearer Understanding of Your Business Model

Unit economics helps you assess whether your customer acquisition costs translate into sustainable profits—and how quickly those costs can be recovered.

2. Strengthen Financial Planning & Cash Flow Management

Understanding CAC recovery timelines helps forecast revenue accurately and manage budgets effectively.

3. Refine Your Product for Market Success

If the cost of acquiring customers outweighs their lifetime value, adjustments in pricing, retention strategies, or operational efficiency may be needed.

💡 Pro Tip: The earlier you begin tracking unit economics, the stronger your foundation for growth. Data-driven insights not only help you refine your strategy but also position your startup as an attractive opportunity for investors.

How to Calculate Your Startup’s Unit Economics 📊

There isn’t a one-size-fits-all approach to calculating unit economics. The method you choose depends on your business model and how you define a "unit." Below, we explore two primary ways to measure unit economics.

Method 1: One Unit = One Item Sold

For businesses that sell physical products—like a donut shop—you can calculate unit economics using the contribution margin formula.

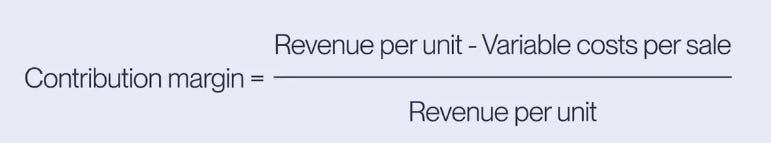

Contribution Margin Formula:

A higher contribution margin means more money to cover fixed costs like rent, salaries, and marketing. The goal is to maximize this margin to ensure profitability.

Method 2: One Unit = One Customer

For SaaS startups and recurring revenue models, focus on three core metrics:

Lifetime Value (LTV): Total revenue a customer generates.

Customer Acquisition Cost (CAC): Total cost to acquire a new customer.

Payback Period: Time taken to recover CAC.

Diving Deeper into Unit Economics Metrics

Understanding the formulas for unit economics is essential, but equally important is breaking down the key components that drive these calculations. Let’s take a closer look at the core metrics:

Customer Lifetime Value (LTV)

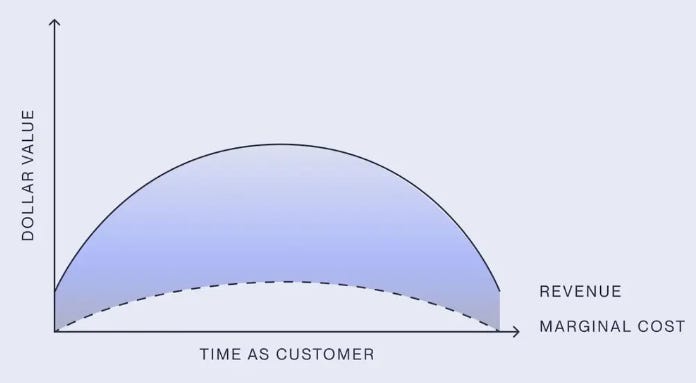

LTV represents the total profit a customer brings to your business throughout their relationship with you. Since customer value varies based on different factors, it’s often best to analyze LTV in specific cohorts or segments. However, be mindful of outliers that could skew the data.

Several elements influence LTV:

Average Revenue Per User (ARPU): This metric tracks how much revenue a customer generates within a specific timeframe, such as a month. Changes in ARPU may result from upselling, cross-selling, or an increase in transaction frequency.

Cost of Goods Sold (COGS): The direct costs of producing and delivering your product or service, such as raw materials and labor.

Marginal Cost: In addition to COGS, this includes variable costs that increase with customer growth, like support or hosting expenses.

Customer Lifetime: This refers to how long a customer continues generating revenue before churning. For subscription-based businesses, retention data helps estimate this.

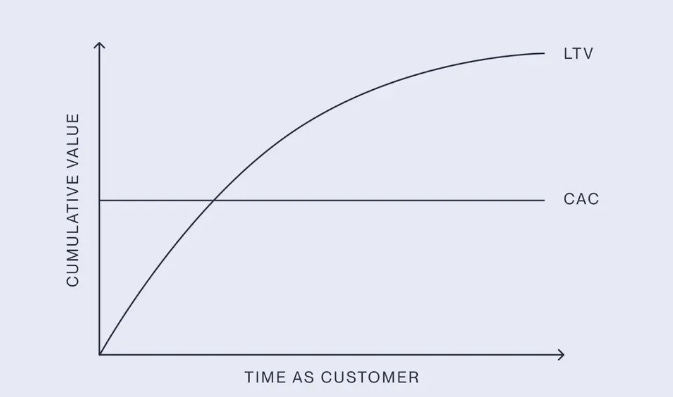

Since LTV requires forecasting, calculating it with precision can be challenging. While it may seem ideal to wait for long-term data, startups should aim to estimate LTV as soon as possible after acquiring customers. Various statistical models can improve accuracy, but they still rely on assumptions about customer behavior and product usage.

Forecasting Customer Lifetime

When predicting LTV, businesses typically use one of two approaches:

Perpetual Forecasting with Discounted Cash Flow: This method estimates future revenue indefinitely and applies a discount rate based on capital costs.

Fixed-Timeframe Forecasting (3-5 Years): This approach is more straightforward and prevents over-reliance on speculative future revenue.

For early-stage startups, the second method is often preferable, as it avoids excessive assumptions and potential overestimation of future earnings.

📌 Pro Tip: Even if you don’t have sophisticated analytics tools, a well-structured spreadsheet can effectively track LTV in your startup’s early stages.

Customer Acquisition Cost (CAC)

CAC measures the average cost of acquiring a new customer and is usually broken down by acquisition channel (e.g., organic, paid ads, sales outreach). The formula is straightforward:

For example:

If a company spends $500,000 on Google Ads in a month and acquires 500 customers through that channel, the CAC per customer is $1,000.

If total marketing expenses across all channels amount to $1.2M in a month and result in 4,000 new customers, the overall CAC is $300.

LTV-to-CAC Ratio: A Key Indicator of Profitability

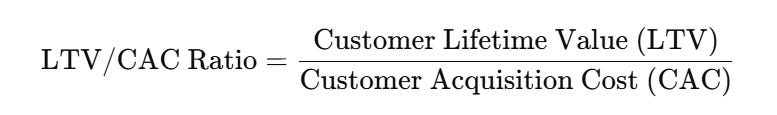

One of the most critical unit economics ratios is LTV ÷ CAC, which determines how much value your business gains for every dollar spent on customer acquisition.

LTV/CAC > 1 → Your business is profitable on a per-customer basis.

LTV/CAC < 1 → You’re losing money on every acquired customer.

A commonly accepted "healthy" LTV/CAC ratio is 3:1, meaning you earn three times more from a customer than it costs to acquire them. If the ratio is too high (e.g., 6:1 or more), you might be underinvesting in customer acquisition, missing potential growth opportunities.

📌 Investor Insight: Startups with strong LTV/CAC ratios are more appealing to investors, while businesses with unsustainable ratios may struggle to secure funding.

How Netflix Mastered Unit Economics

Netflix’s success is a masterclass in unit economics, balancing high LTV and low CAC for long-term profitability.

Maximizing LTV

Netflix ensures high retention with personalized recommendations, premium pricing, and hit content like Stranger Things. This keeps users engaged and maximizes revenue per subscriber.

Minimizing CAC

Viral content marketing, targeted ads, and global expansion reduce acquisition costs. Data-driven strategies further optimize spending, ensuring efficient customer growth.

Netflix’s Key Metrics

📊 LTV: ~$540 | CAC: ~$100

📈 LTV/CAC Ratio: 5.4 | Payback Period: ~7 months

With high LTV, low CAC, and fast payback, Netflix scales profitably, proving the power of strong unit economics.

Mastering Unit Economics: Your Ultimate Learning Toolkit

Books

"Unit Economics: Data Driven Decisions for Business and Startups" by Daniil Khanin and Tatyana Zharova

"The Lean Startup" by Eric Ries

YouTube Videos

"The Ultimate SaaS Unit Economics Tutorial"

Tailored for SaaS startups, this tutorial delves into key metrics like LTV, CAC, and payback periods, offering practical guidance on achieving profitability."Unit Economics for Startups | eCommerce, Software & Hardware"

This video explores the application of unit economics across various business models, including eCommerce, software, and hardware startups.Online Tools

ueCalc.com

Developed by Daniil Khanin, this online tool assists startups in creating and analyzing unit economics models.A powerful financial analysis and forecasting tool that helps startups visualize unit economics, track key metrics, and make data-driven decisions.

The Smart Growth Wrap-Up

Mastering unit economics isn’t just about numbers—it’s about building a business that thrives. Understanding metrics like LTV, CAC, and payback period empowers you to make smarter decisions, optimize growth, and attract investors. Stay data-driven, iterate constantly, and turn insights into action. Strong unit economics is your blueprint for sustainable success!

How Xartup Helps You Fundraise Smarter

Instead of blindly reaching out to investors, use a strategic approach:

✅ Leverage Xartup’s Investor Database to find the right VCs based on sector & stage.

✅ Join the Xartup Fellowship to access mentorship & growth resources.

✅ Get Technical Credits to test your product and many more.

🚀 Ready to optimize your fundraising? Join xartup.com