How to Raise Your First-Round Funding: A Guide for Early-Stage Founders

Tips to secure your startup’s initial investment along with a curated list of investors eager to support early stage startups

You’ve launched your startup, validated your idea, and now it’s time to scale—but funding is standing in your way. Sure, you’ve tapped into the friends and family network, but to make real progress, you need external investors who can bring both capital and expertise to the table. The question is, where do you start?

In this guide, we’ll take you step-by-step through raising your first round of funding, from setting clear goals to pitching the right investors. At the end, we’ll share a curated list of angel investors ready to support your vision.

Why Do You Need Fundraising in the First Place?

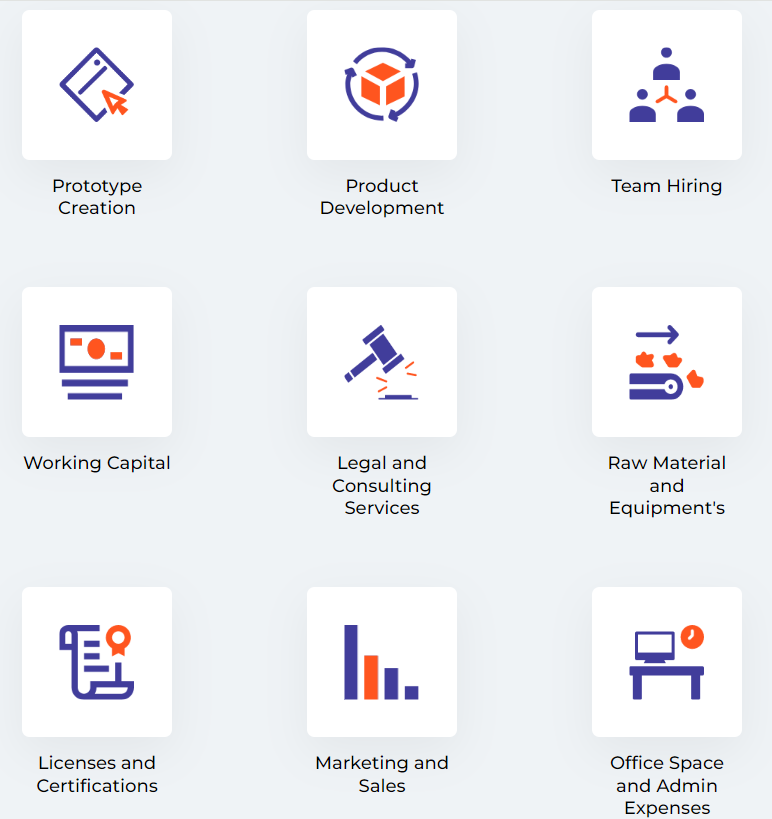

Before you dive into raising capital, it's essential to understand why you need it. For startups, external funding isn’t just about survival—it’s about fueling growth. It’s crucial for founders to develop a thorough financial and business plan before engaging with potential investors. Here's why you might need fundraising:

At What Stage Is Your Startup?

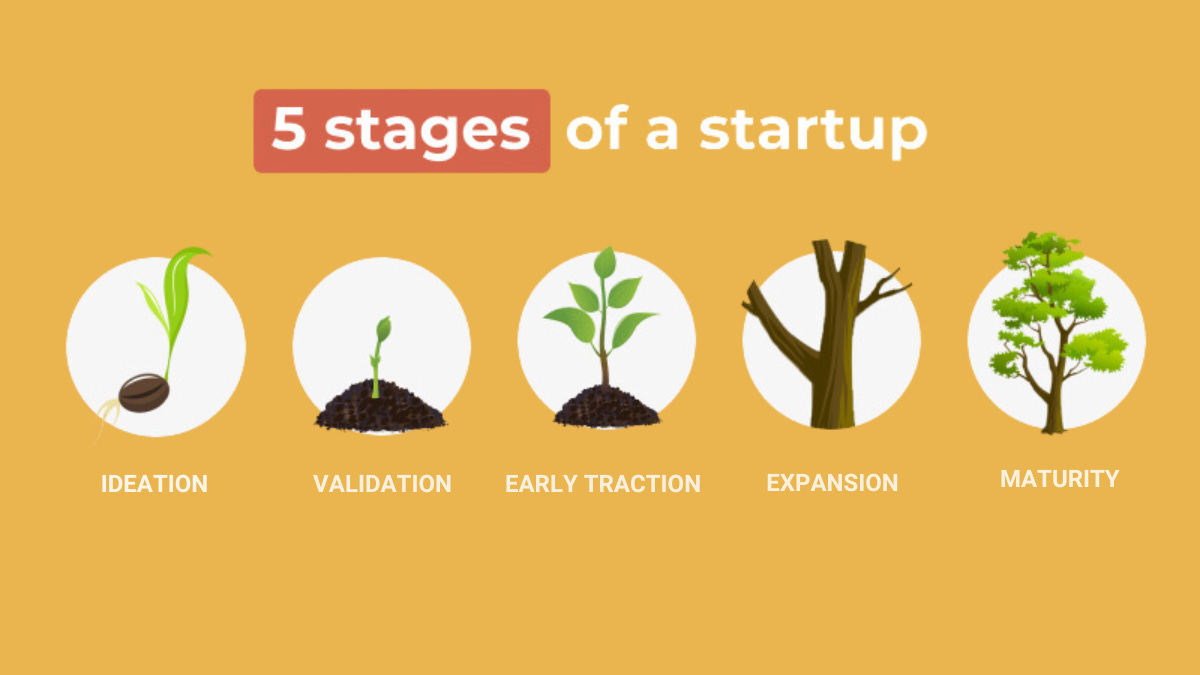

Understanding your startup’s stage is crucial when seeking the right type of funding. Investors look for startups at different stages, each with its own needs, risks, and funding sources. Here’s a breakdown of the common stages:

Ideation Stage: At this stage, you’re still refining your concept, working on the foundational idea of your startup. You might not have a product yet, but you're building the groundwork for its development.

Validation Stage: You’ve taken your idea further by creating a prototype or a minimum viable product (MVP). Now, you're testing it with potential customers to validate demand and refine the product.

Early Traction Stage: You’ve validated your idea and have some initial users or customers. Your focus is on building early traction and beginning to generate revenue.

Scaling Stage: At this stage, your product is established, and you’re ready to scale the business. You’ve achieved product-market fit and are focused on expanding your operations, hiring key personnel, and entering new markets.

Maturity Stage: Your startup has reached a mature stage where you’re preparing for an exit, whether through an acquisition, merger, or an initial public offering (IPO).

Understanding where your startup stands enables you to connect with the right investors and access the funding necessary to push your business to the next level. Now, we would be talking about the types of investors and early stage founders which would help you to reach out to the right investors.

What types of Investors to approach and how much should you ask for your first round?

Your first round typically depends at which stage your startup is at. Here's a breakdown of the common investor types, the amount they typically invest, and the startup stages they focus on:

1. Friends and Family

Investment Size: ₹1 lakh – ₹10 lakh

Stage: Ideation to Validation

Description: Friends and family are usually the first people entrepreneurs turn to for capital. While the investment amounts may be small, this is often the initial push a founder needs to get started.

2. Angel Investors

Investment Size: ₹10 lakh – ₹2 crore

Stage: Validation to Early Traction

Description: Angel investors are typically individuals who invest their own money into startups, often in exchange for equity. They’re ideal for early-stage startups that have validated their business model and are showing initial traction. Angels may provide more flexible terms than larger investors.

3. Seed Funds

Investment Size: ₹1 crore – ₹5 crore

Stage: Validation to Early Traction

Description: Seed funds specialize in helping startups during their early stages. They provide capital to help startups achieve key milestones, such as completing product development or expanding their team, before raising larger rounds of funding.

4. Venture Capital (VC) Firms

Investment Size: ₹5 crore – ₹50 crore+

Stage: Early Traction to Scaling

Description: VC firms invest in high-growth startups, often seeking larger equity stakes and quicker returns.

Learn more about VCs

5. Corporate Investors

Investment Size: ₹5 crore – ₹100 crore+

Stage: Early Traction to Scaling

Description: Corporate investors, usually large companies, invest in startups either as part of their innovation strategy or to acquire a strategic advantage. These investments are usually larger and may come with partnerships or collaborations that can accelerate a startup’s growth.

6. Private Equity (PE) Firms

Investment Size: ₹50 crore – ₹100 crore+

Stage: Scaling to Exit

Description: Private equity firms focus on established companies that have already demonstrated strong growth and profitability. Their investments are typically much larger, and they may seek controlling stakes in the company. PE firms aim to maximize returns by taking the company to the next level or preparing it for an exit, such as an acquisition or IPO.

7. Crowdfunding

Investment Size: ₹10 lakh – ₹1 crore (depending on the platform)

Stage: Validation to Early Traction

Description: Crowdfunding allows startups to raise small amounts of capital from a large pool of investors, typically through online platforms. It’s a good option for startups looking to validate their product with real customers while raising capital. This method also helps create a built-in audience and community for the startup.

Learn more about Crowdfunding in India

8. Government Grants and Schemes

Investment Size: Varies (often up to ₹50 lakh or more)

Stage: Ideation to Validation

Description: Governments, especially in countries like India, offer grants, subsidies, and soft loans to startups in various sectors. These funds are non-dilutive, meaning you don’t have to give up equity. They’re ideal for early-stage startups and may come with additional benefits like incubation and mentorship.

Learn more about Government Grants in India

The first round of funding is a significant milestone in your startup’s journey. With a clear strategy and a compelling pitch, you can set the stage for long-term success. And don’t worry, we’ve got your back. Below, you’ll find a list of angel investors eager to invest in early stage startups . Let’s find out.

Angel Investors List:

List of Angel Investors and VCs in India

Active Pre-Seed Investors

US Founders Who Invest in Others as Angels

300 Australian Early-Stage Investors

SaaS Angel Investors (Globally)

350+ Most Active Angel Investors in USA

Crypto Angel Investors

Angel Investors Based Out of Africa

Angel Investors from Diverse Backgrounds

If you are building a business, apply to Xartup Fellowship Program where we have a thriving community of 2,400+ founders navigating through one of the toughest time in the Indian startup ecosystem.

It’s been an amazing journey for the Xartup Fellowship Program Fellows

2400+ Alumni

300+ Startups

$5M+ in funding raised by Alumni